Home > Legal >

Legal >

Rent and Lease Template > Ohio Rent and Lease Template >

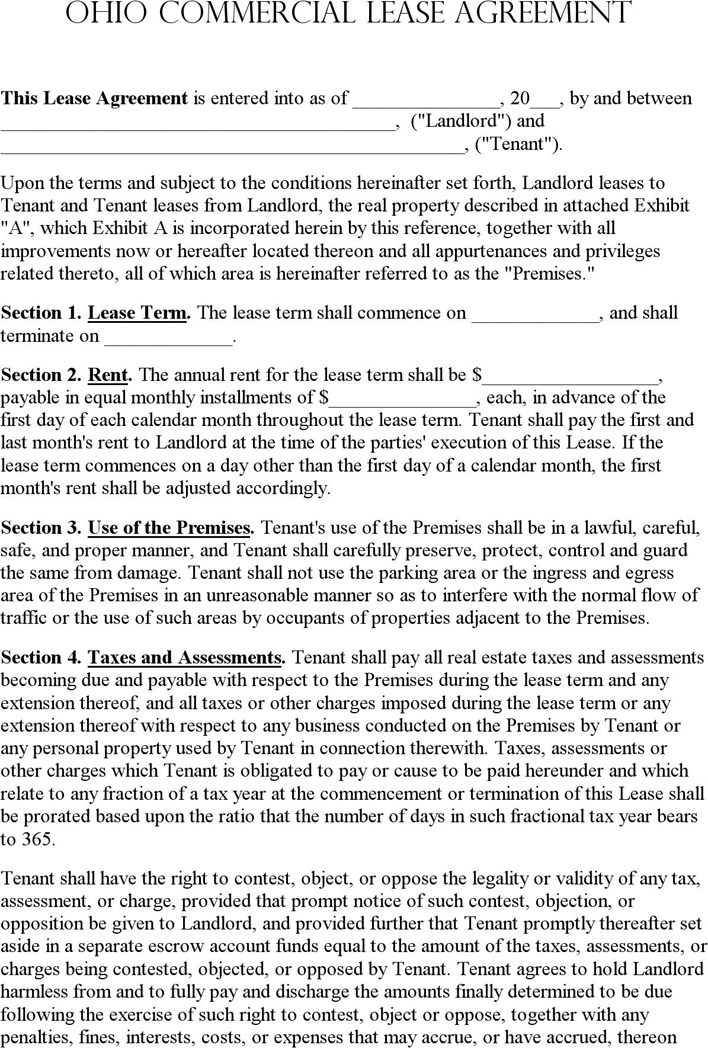

Ohio Commercial Lease Agreement Template

Ohio Commercial Lease Agreement Template

At Speedy Template, You can download Ohio Commercial Lease Agreement Template . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

This Lease Agreement is entered into as of _______________, 20___, by and between

________________________________________, ("Landlord") and

_______________________________________________, ("Tenant").

Upon the terms and subject to the conditions hereinafter set forth, Landlord leases to

Tenant and Tenant leases from Landlord, the real property described in attached Exhibit

"A", which Exhibit A is incorporated herein by this reference, together with all

improvements now or hereafter located thereon and all appurtenances and privileges

related thereto, all of which area is hereinafter referred to as the "Premises."

Section 1. Lease Term. The lease term shall commence on _____________, and shall

terminate on _____________.

Section 2. Rent. The annual rent for the lease term shall be $__________________,

payable in equal monthly installments of $_______________, each, in advance of the

first day of each calendar month throughout the lease term. Tenant shall pay the first and

last month's rent to Landlord at the time of the parties' execution of this Lease. If the

lease term commences on a day other than the first day of a calendar month, the first

month's rent shall be adjusted accordingly.

Section 3. Use of the Premises. Tenant's use of the Premises shall be in a lawful, careful,

safe, and proper manner, and Tenant shall carefully preserve, protect, control and guard

the same from damage. Tenant shall not use the parking area or the ingress and egress

area of the Premises in an unreasonable manner so as to interfere with the normal flow of

traffic or the use of such areas by occupants of properties adjacent to the Premises.

Section 4. Taxes and Assessments. Tenant shall pay all real estate taxes and assessments

becoming due and payable with respect to the Premises during the lease term and any

extension thereof, and all taxes or other charges imposed during the lease term or any

extension thereof with respect to any business conducted on the Premises by Tenant or

any personal property used by Tenant in connection therewith. Taxes, assessments or

other charges which Tenant is obligated to pay or cause to be paid hereunder and which

relate to any fraction of a tax year at the commencement or termination of this Lease shall

be prorated based upon the ratio that the number of days in such fractional tax year bears

to 365.

Tenant shall have the right to contest, object, or oppose the legality or validity of any tax,

assessment, or charge, provided that prompt notice of such contest, objection, or

opposition be given to Landlord, and provided further that Tenant promptly thereafter set

aside in a separate escrow account funds equal to the amount of the taxes, assessments, or

charges being contested, objected, or opposed by Tenant. Tenant agrees to hold Landlord

harmless from and to fully pay and discharge the amounts finally determined to be due

following the exercise of such right to contest, object or oppose, together with any

penalties, fines, interests, costs, or expenses that may accrue, or have accrued, thereon

OHIO COMMERCIAL LEASE AGREEMENT