Promissory Note Template - How to Write a Promissory Note?

A promissory note, also called just a note or a note payable, is a legal document that can be used for a financial transaction involving two parties at a later date or under certain conditions at the demand of a loaner. It is simple a written agreement for the repayment of a debt. A person can be fined and taken to court if they fail to abide by the conditions of a signed promissory note.

Promissory notes are written commonly by lenders, banks, and lawyers. However, it will be just as legal if written properly by two individuals. This means that you could complete and sign a note form for relatives when borrowing money from a friend or family member.

Aside from writing a promissory note for relatives, you could use a form for rent collection, student loans, employee loans, car purchases, and more. It will help greatly with your collection efforts if you learn how to write a promissory note.

How to Write a Promissory Note?

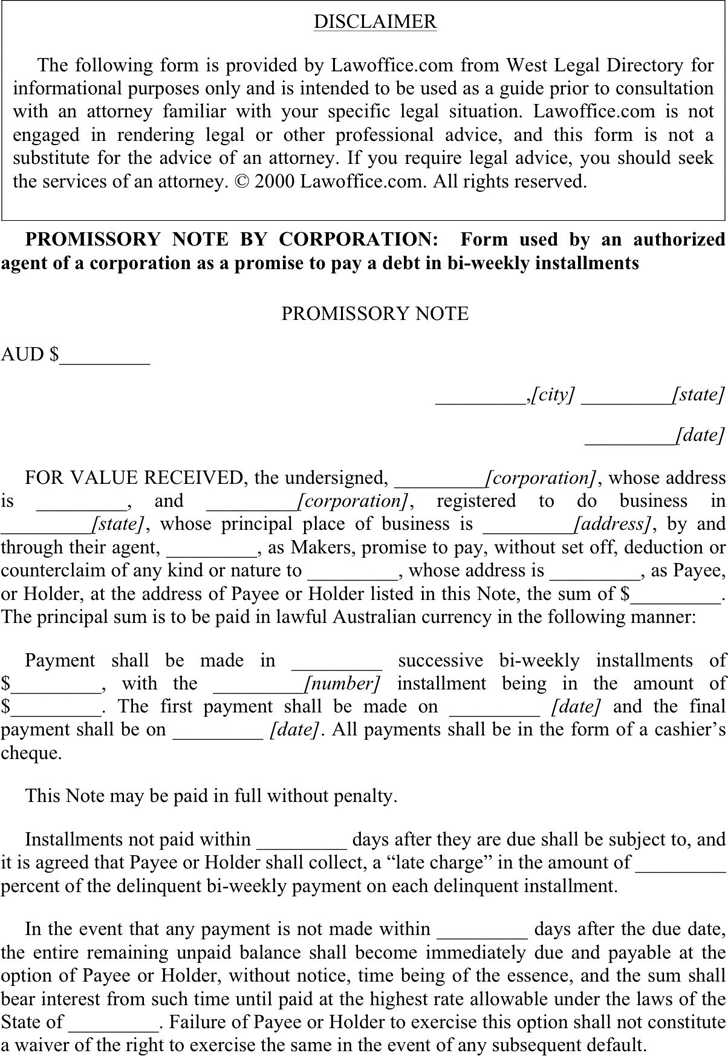

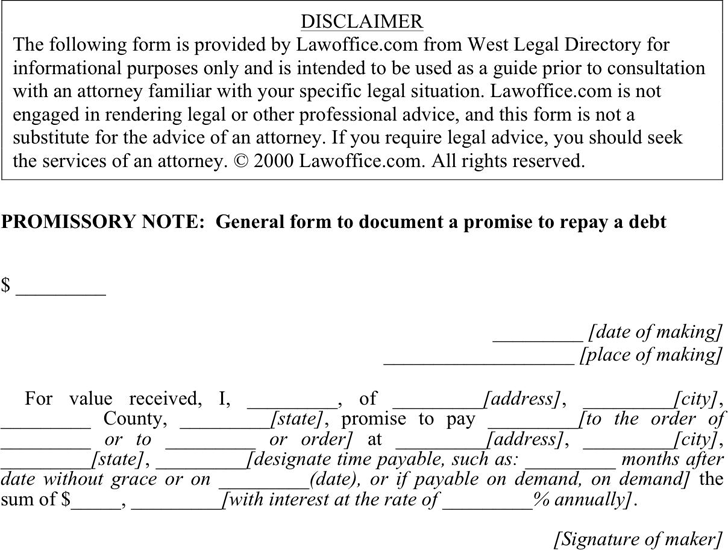

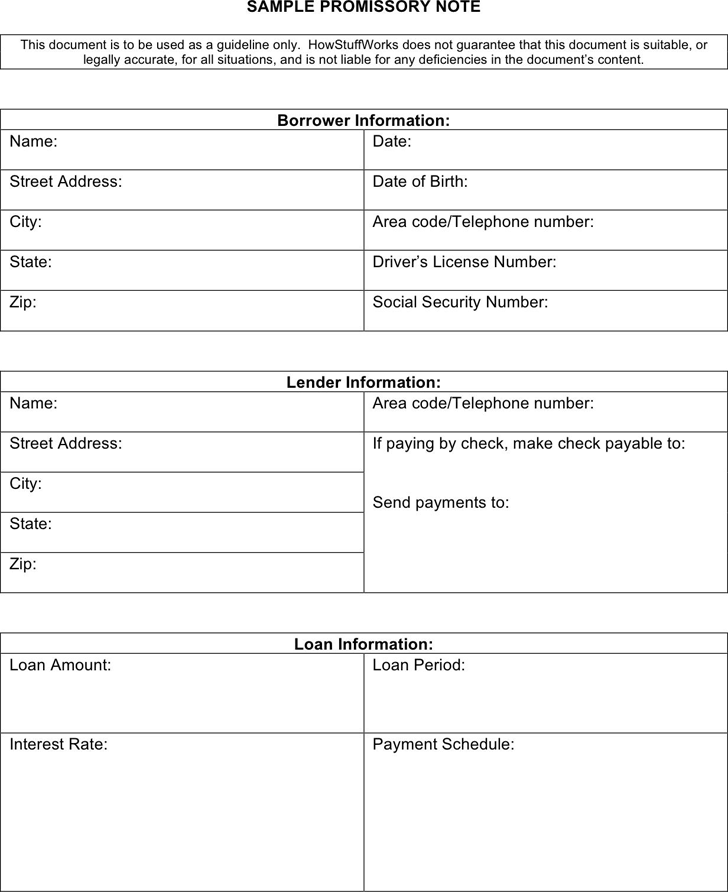

In general, this note will basically include the name of the lender and borrower, the amount, date when it’s given, the date for the full repayment, frequency of payments, interest rate charged, as well as any security agreement.

1. Get a blank promissory note and write the date on top of the page.

2. Add the names of the lender and borrower, indicating who is which.

3. Add the loan amount. This should be written in words, using long form and numeric value.

4. Describe the terms, including how the borrower should repay, be it through quarterly, monthly or weekly installments.

5. Describe the rate of interest in numeric value, using long form and a percentage sign. State whether the interest rate is variable or fixed.

6. Specify if it’s an unsecured or a secured note. If collateral is used to secure a loan, you should put this on the promissory note template. For example, the description of the building and the property address should be written if a commercial property or a home s used to secure the loan.

7. State the complete mailing address for the payments to be sent.

8. The borrower(s) should print and then sign name, plus date the note in order to acknowledge the responsibility to repay the loan.

Whether you are writing a free promissory note form to give a personal loan or your business is lending funds to someone, a promissory note will be a legal contract between you the lender and borrower.

If you are looking for promissory note examples, you can find free ones readily online. Most forms can fit any situation, but you it would not hurt for you to have an attorney review the repayment terms and other conditions.