Home > Legal >

Legal >

Divorce Template > Connecticut Divorce Form >

Connecticut Child Support and Arrearage Gudelines

Connecticut Child Support and Arrearage Gudelines

At Speedy Template, You can download Connecticut Child Support and Arrearage Gudelines . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

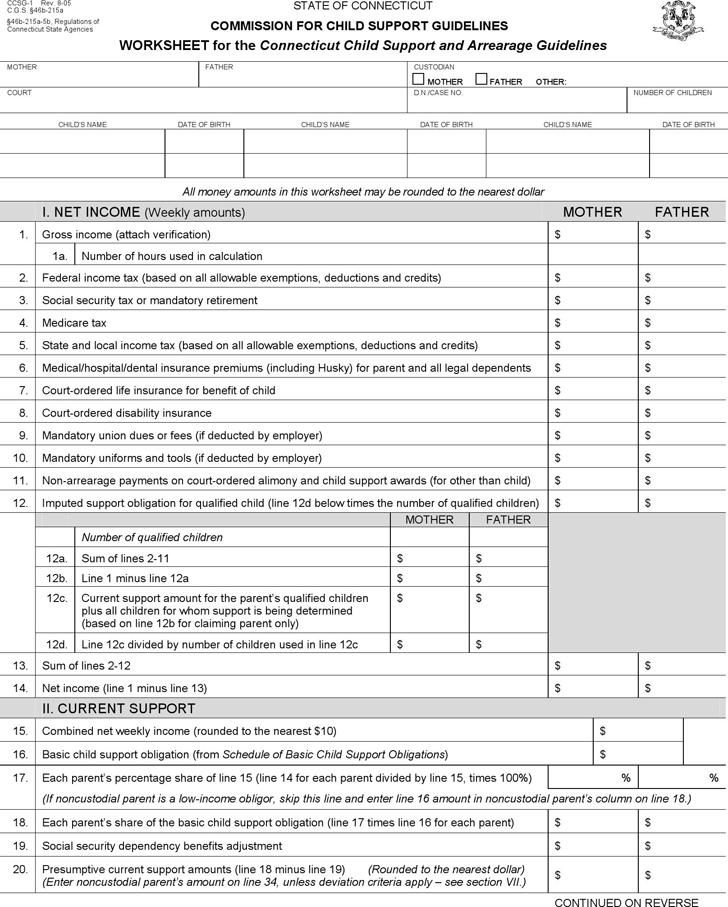

CCSG-1 Rev. 8-05

C.G.S. §46b-215a

STATE OF CONNECTICUT

§46b-215a-5b, Regulations of

Connecticut State Agencies

COMMISSION FOR CHILD SUPPORT GUIDELINES

WORKSHEET for the Connecticut Child Support and Arrearage Guidelines

MOTHER FATHER CUSTODIAN

MOTHER FATHER OTHER:

COURT D.N./CASE NO. NUMBER OF CHILDREN

CHILD’S NAME DATE OF BIRTH CHILD’S NAME DATE OF BIRTH CHILD’S NAME DATE OF BIRTH

All money amounts in this worksheet may be rounded to the nearest dollar

I. NET INCOME (Weekly amounts) MOTHER FATHER

Gross income (attach verification) $ $ 1.

1a. Number of hours used in calculation

2. Federal income tax (based on all allowable exemptions, deductions and credits) $ $

3. Social security tax or mandatory retirement $ $

4. Medicare tax $ $

5. State and local income tax (based on all allowable exemptions, deductions and credits) $ $

6. Medical/hospital/dental insurance premiums (including Husky) for parent and all legal dependents $ $

7. Court-ordered life insurance for benefit of child $ $

8. Court-ordered disability insurance $ $

9. Mandatory union dues or fees (if deducted by employer) $ $

10. Mandatory uniforms and tools (if deducted by employer) $ $

11. Non-arrearage payments on court-ordered alimony and child support awards (for other than child) $ $

12. Imputed support obligation for qualified child (line 12d below times the number of qualified children) $ $

MOTHER FATHER

Number of qualified children

12a. Sum of lines 2-11 $ $

12b. Line 1 minus line 12a $ $

12c. Current support amount for the parent’s qualified children

plus all children for whom support is being determined

(based on line 12b for claiming parent only)

$ $

12d. Line 12c divided by number of children used in line 12c $ $

13. Sum of lines 2-12 $ $

14. Net income (line 1 minus line 13) $ $

II. CURRENT SUPPORT

15. Combined net weekly income (rounded to the nearest $10) $

16. Basic child support obligation (from Schedule of Basic Child Support Obligations) $

17. Each parent’s percentage share of line 15 (line 14 for each parent divided by line 15, times 100%) % %

(If noncustodial parent is a low-income obligor, skip this line and enter line 16 amount in noncustodial parent’s column on line 18.)

18. Each parent’s share of the basic child support obligation (line 17 times line 16 for each parent) $ $

19. Social security dependency benefits adjustment $ $

20. Presumptive current support amounts (line 18 minus line 19) (Rounded to the nearest dollar)

(Enter noncustodial parent’s amount on line 34, unless deviation criteria apply – see section VII.)

$ $

CONTINUED ON REVERSE