Home > Legal >

Legal >

Power of Attorney Template > Mississippi Power of Attorney Form >

Mississippi Tax Power of Attorney Template

Mississippi Tax Power of Attorney Form

At Speedy Template, You can download Mississippi Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Mississippi tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

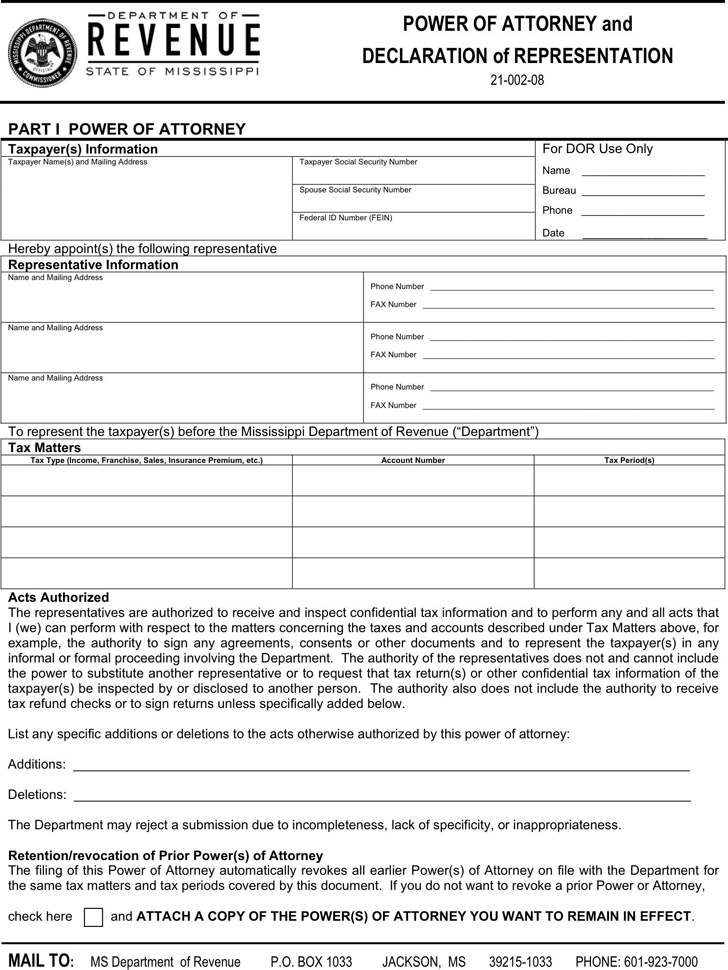

POWER OF ATTORNEY and

DECLARATION of REPRESENTATION

21-002-08

MAIL TO: MS Department of Revenue P.O. BOX 1033 JACKSON, MS 39215-1033 PHONE: 601-923-7000

PART I POWER OF ATTORNEY

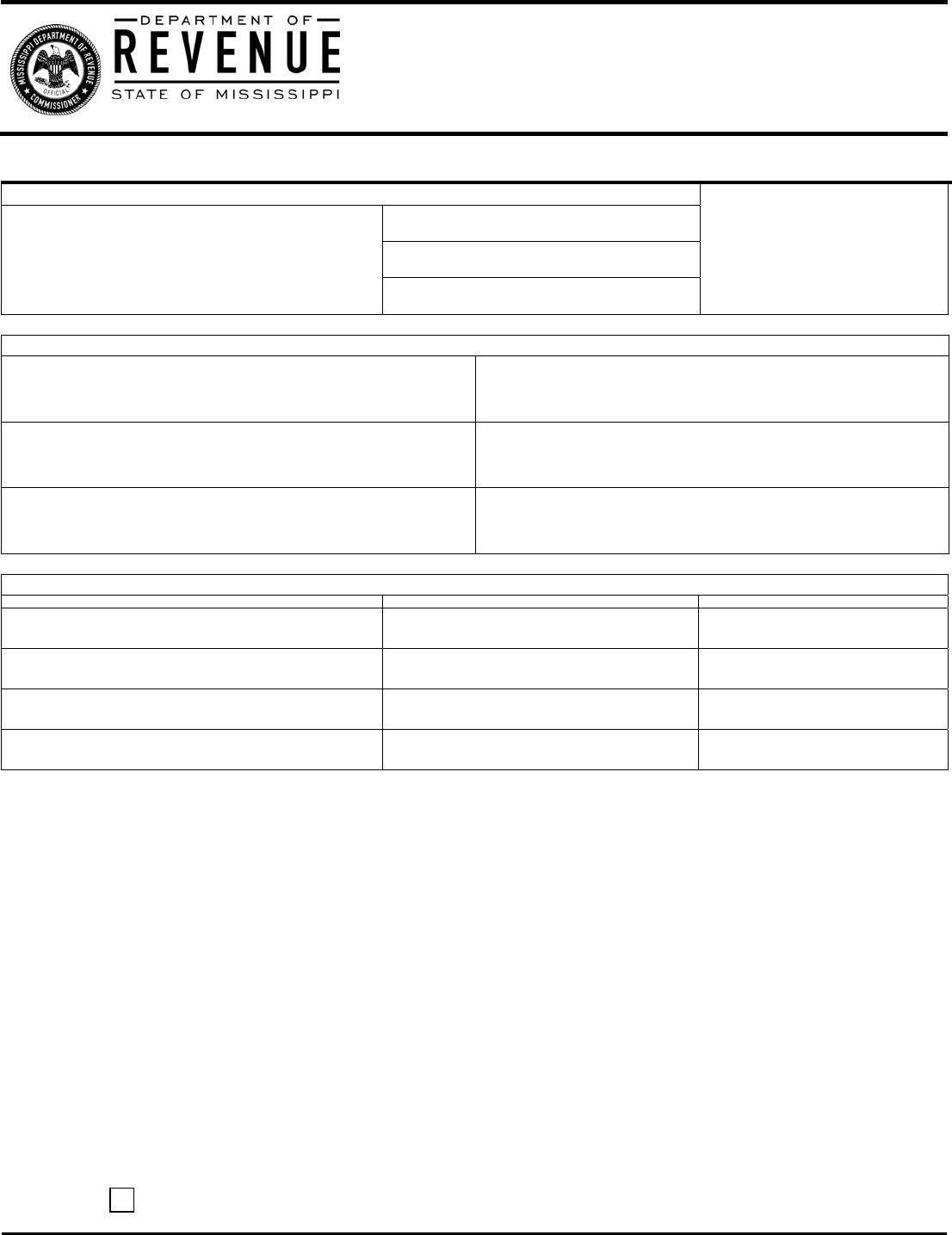

Taxpayer(s) Information

For DOR Use Only

Name _____________________

Bureau _____________________

Phone _____________________

Date

_________________

Taxpayer Name(s) and Mailing Address Taxpayer Social Security Number

Spouse Social Security Number

Federal ID Number (FEIN)

Hereby appoint(s) the following representative

Representative Information

Name and Mailing Address

Phone Number ________________________________________________________________

FAX Number __________________________________________________________________

Name and Mailing Address

Phone Number ________________________________________________________________

FAX Number __________________________________________________________________

Name and Mailing Address

Phone Number ________________________________________________________________

FAX Number __________________________________________________________________

To represent the taxpayer(s) before the Mississippi Department of Revenue (“Department”)

Tax Matters

Tax Type (Income, Franchise, Sales, Insurance Premium, etc.) Account Number Tax Period(s)

Acts Authorized

The representatives are authorized to receive and inspect confidential tax information and to perform any and all acts that

I (we) can perform with respect to the matters concerning the taxes and accounts described under Tax Matters above, for

example, the authority to sign any agreements, consents or other documents and to represent the taxpayer(s) in any

informal or formal proceeding involving the Department. The authority of the representatives does not and cannot include

the power to substitute another representative or to request that tax return(s) or other confidential tax information of the

taxpayer(s) be inspected by or disclosed to another person. The authority also does not include the authority to receive

tax refund checks or to sign returns unless specifically added below.

List any specific additions or deletions to the acts otherwise authorized by this power of attorney:

Additions: ____________________________________________________________________________________

Deletions: ____________________________________________________________________________________

The Department may reject a submission due to incompleteness, lack of specificity, or inappropriateness.

Retention/revocation of Prior Power(s) of Attorney

The filing of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on file with the Department for

the same tax matters and tax periods covered by this document. If you do not want to revoke a prior Power or Attorney,

check here and ATTACH A COPY OF THE POWER(S) OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.