Home > Legal >

Legal >

Power of Attorney Template > Vermont Power of Attorney Form >

Vermont Tax Power of Attorney Template

Vermont Tax Power of Attorney Form

At Speedy Template, You can download Vermont Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

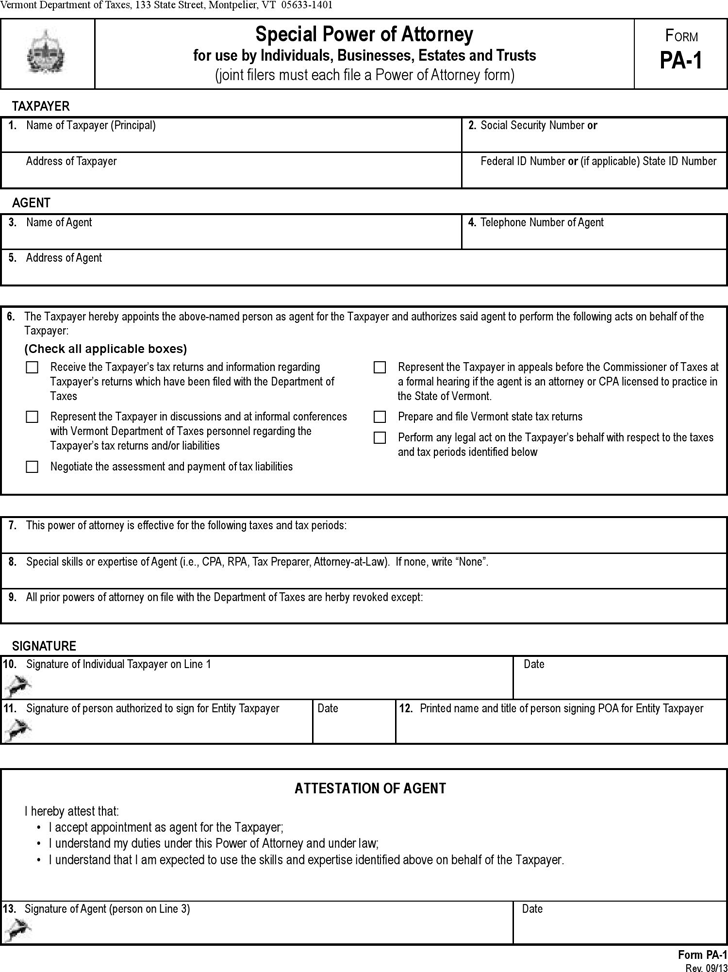

Form PA-1

Rev. 09/13

Special Power of Attorney

for use by Individuals, Businesses, Estates and Trusts

(joint lers must each le a Power of Attorney form)

Form

PA-1

Vermont Department of Taxes, 133 State Street, Montpelier, VT 05633-1401

6. The Taxpayer hereby appoints the above-named person as agent for the Taxpayer and authorizes said agent to perform the following acts on behalf of the

Taxpayer:

(Check all applicable boxes)

Receive the Taxpayer’s tax returns and information regarding

Taxpayer’s returns which have been filed with the Department of

Taxes

Represent the Taxpayer in discussions and at informal conferences

with Vermont Department of Taxes personnel regarding the

Taxpayer’s tax returns and/or liabilities

Negotiate the assessment and payment of tax liabilities

Represent the Taxpayer in appeals before the Commissioner of Taxes at

a formal hearing if the agent is an attorney or CPA licensed to practice in

the State of Vermont.

Prepare and file Vermont state tax returns

Perform any legal act on the Taxpayer’s behalf with respect to the taxes

and tax periods identified below

3. Name of Agent 4. Telephone Number of Agent

5. Address of Agent

AGENT

7. This power of attorney is effective for the following taxes and tax periods:

8. Special skills or expertise of Agent (i.e., CPA, RPA, Tax Preparer, Attorney-at-Law). If none, write “None”.

9. All prior powers of attorney on le with the Department of Taxes are herby revoked except:

13. Signature of Agent (person on Line 3) Date

ATTESTATION OF AGENT

I hereby attest that:

• I accept appointment as agent for the Taxpayer;

• I understand my duties under this Power of Attorney and under law;

• I understand that I am expected to use the skills and expertise identified above on behalf of the Taxpayer.

TAXPAYER

1. Name of Taxpayer (Principal) 2. Social Security Number or

Address of Taxpayer Federal ID Number or (if applicable) State ID Number

SIGNATURE

10. Signature of Individual Taxpayer on Line 1 Date

11. Signature of person authorized to sign for Entity Taxpayer Date 12. Printed name and title of person signing POA for Entity Taxpayer