Home > Legal >

Legal >

Power of Attorney Template > Utah Power of Attorney Form >

Utah Tax Power of Attorney Template

Utah Tax Power of Attorney Form

At Speedy Template, You can download Utah Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Utah tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

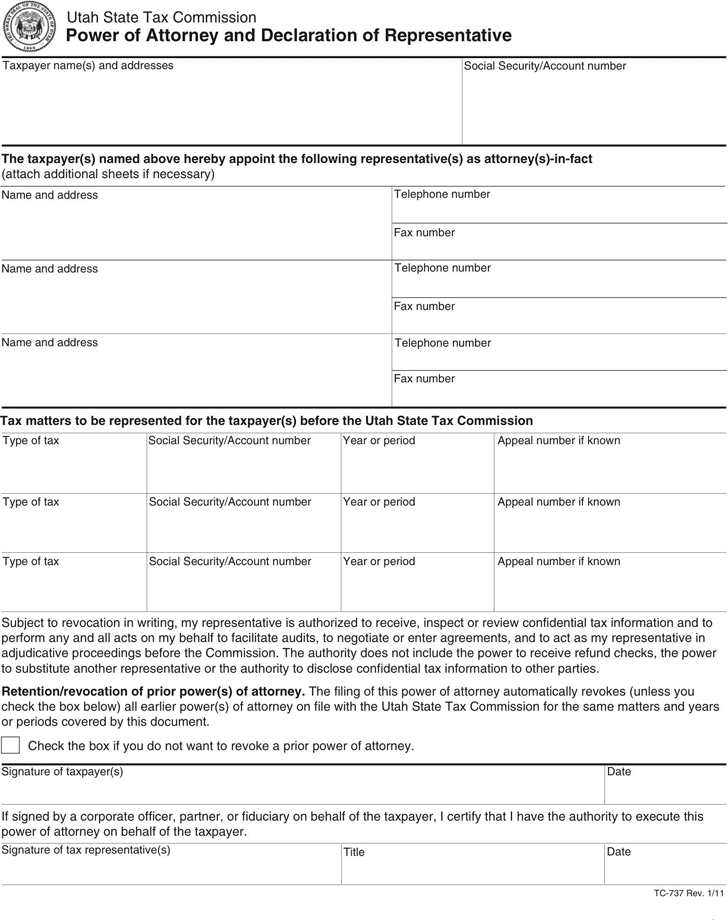

Utah State Tax Commission

Power of Attorney and Declaration of Representative

Taxpayer name(s) and addresses

Social Security/Account number

The taxpayer(s) named above hereby appoint the following representative(s) as attorney(s)-in-fact

(attach additional sheets if necessary)

Name and address

Fax number

Name and address

Fax number

Name and address

Fax number

Tax matters to be represented for the taxpayer(s) before the Utah State Tax Commission

Type of tax Social Security/Account number Year or period Appeal number if known

Type of tax Social Security/Account number Year or period Appeal number if known

Type of tax Social Security/Account number Year or period Appeal number if known

Signature of taxpayer(s) Date

If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this

power of attorney on behalf of the taxpayer.

Signature of tax representative(s)

Title

TC-737 Rev. 1/11

Subject to revocation in writing, my representative is authorized to receive, inspect or review confidential tax information and to

perform any and all acts on my behalf to facilitate audits, to negotiate or enter agreements, and to act as my representative in

adjudicative proceedings before the Commission. The authority does not include the power to receive refund checks, the power

to substitute another representative or the authority to disclose confidential tax information to other parties.

Retention/revocation of prior power(s) of attorney. The filing of this power of attorney automatically revokes (unless you

check the box below) all earlier power(s) of attorney on file with the Utah State Tax Commission for the same matters and years

or periods covered by this document.

Date

Telephone number

Telephone number

Telephone number

Check the box if you do not want to revoke a prior power of attorney.

Clear form

Utah Tax Power of Attorney Form