Home > Business >

Agreement Template >

Sample Partnership Agreement >

Sample Partnership Agreement 2

Sample Partnership Agreement 2

At Speedy Template, You can download Sample Partnership Agreement 2 . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

1

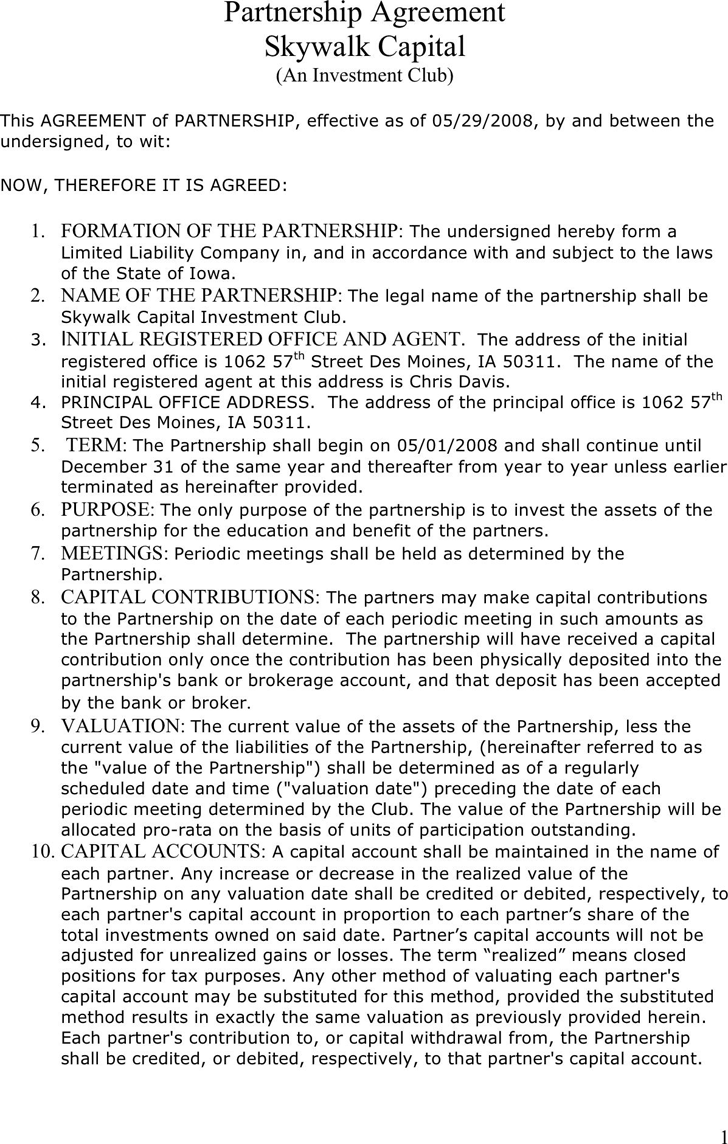

Partnership Agreement

Skywalk Capital

(An Investment Club)

This AGREEMENT of PARTNERSHIP, effective as of 05/29/2008, by and between the

undersigned, to wit:

NOW, THEREFORE IT IS AGREED:

1. FORMATION OF THE PARTNERSHIP: The undersigned hereby form a

Limited Liability Company in, and in accordance with and subject to the laws

of the State of Iowa.

2. NAME OF THE PARTNERSHIP: The legal name of the partnership shall be

Skywalk Capital Investment Club.

3. INITIAL REGISTERED OFFICE AND AGENT. The address of the initial

registered office is 1062 57

th

Street Des Moines, IA 50311. The name of the

initial registered agent at this address is Chris Davis.

4. PRINCIPAL OFFICE ADDRESS. The address of the principal office is 1062 57

th

Street Des Moines, IA 50311.

5. TERM: The Partnership shall begin on 05/01/2008 and shall continue until

December 31 of the same year and thereafter from year to year unless earlier

terminated as hereinafter provided.

6. PURPOSE: The only purpose of the partnership is to invest the assets of the

partnership for the education and benefit of the partners.

7. MEETINGS: Periodic meetings shall be held as determined by the

Partnership.

8. CAPITAL CONTRIBUTIONS: The partners may make capital contributions

to the Partnership on the date of each periodic meeting in such amounts as

the Partnership shall determine. The partnership will have received a capital

contribution only once the contribution has been physically deposited into the

partnership's bank or brokerage account, and that deposit has been accepted

by the bank or broker.

9. VALUATION: The current value of the assets of the Partnership, less the

current value of the liabilities of the Partnership, (hereinafter referred to as

the "value of the Partnership") shall be determined as of a regularly

scheduled date and time ("valuation date") preceding the date of each

periodic meeting determined by the Club. The value of the Partnership will be

allocated pro-rata on the basis of units of participation outstanding.

10. CAPITAL ACCOUNTS: A capital account shall be maintained in the name of

each partner. Any increase or decrease in the realized value of the

Partnership on any valuation date shall be credited or debited, respectively, to

each partner's capital account in proportion to each partner’s share of the

total investments owned on said date. Partner’s capital accounts will not be

adjusted for unrealized gains or losses. The term “realized” means closed

positions for tax purposes. Any other method of valuating each partner's

capital account may be substituted for this method, provided the substituted

method results in exactly the same valuation as previously provided herein.

Each partner's contribution to, or capital withdrawal from, the Partnership

shall be credited, or debited, respectively, to that partner's capital account.