Home > Legal >

Legal >

Power of Attorney Template > Puerto Rico Power of Attorney Form >

Puerto Rico Tax Power of Attorney Template

Puerto Rico Tax Power of Attorney Form

At Speedy Template, You can download Puerto Rico Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

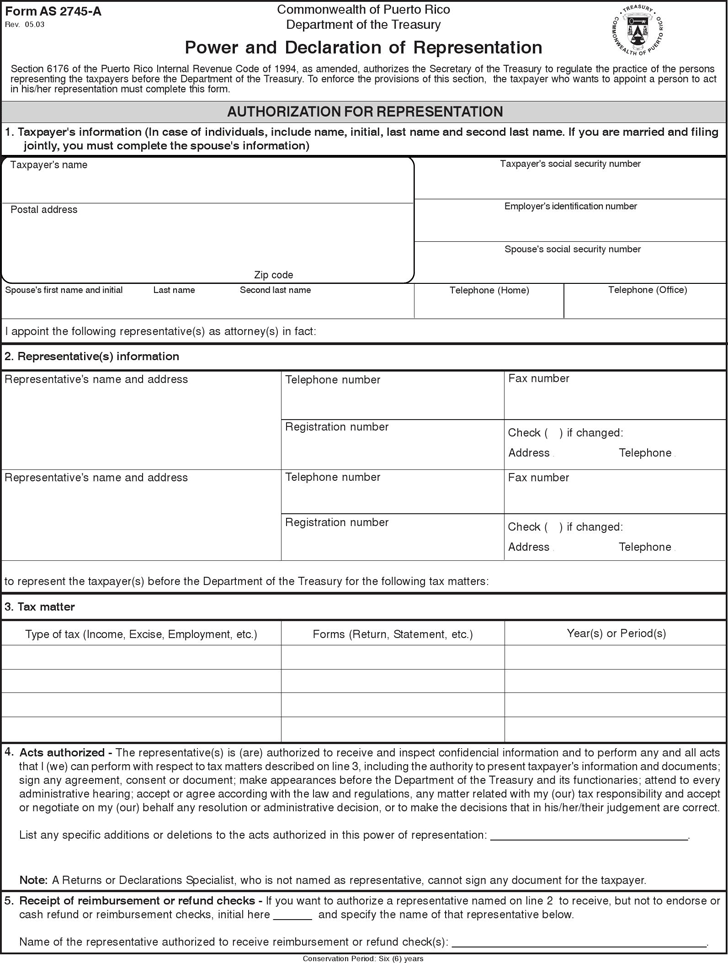

Commonwealth of Puerto Rico

Department of the Treasury

Power and Declaration of Representation

Form AS 2745-A

Rev. 05.03

1. Taxpayer's information (In case of individuals, include name, initial, last name and second last name. If you are married and filing

jointly, you must complete the spouse's information)

Representative's name and address

Telephone number

Telephone number

Registration number

Registration number

Fax number

Fax number

Check (

3) if changed:

Address

q Telephone q

Check (3) if changed:

Address

q Telephone q

Representative's name and address

3. Tax matter

Type of tax (Income, Excise, Employment, etc.)

Forms (Return, Statement, etc.)

Year(s) or Period(s)

4.

Note: A Returns or Declarations Specialist, who is not named as representative, cannot sign any document for the taxpayer.

5.

Acts authorized - The representative(s) is (are) authorized to receive and inspect confidencial information and to perform any and all acts

that I (we) can perform with respect to tax matters described on line 3, including the authority to present taxpayer's information and documents;

sign any agreement, consent or document; make appearances before the Department of the Treasury and its functionaries; attend to every

administrative hearing; accept or agree according with the law and regulations, any matter related with my (our) tax responsibility and accept

or negotiate on my (our) behalf any resolution or administrative decision, or to make the decisions that in his/her/their judgement are correct.

List any specific additions or deletions to the acts authorized in this power of representation: _______________________________.

Receipt of reimbursement or refund checks - If you want to authorize a representative named on line 2 to receive, but not to endorse or

cash refund or reimbursement checks, initial here ______ and specify the name of that representative below.

Name of the representative authorized to receive reimbursement or refund check(s): ________________________________________.

AUTHORIZATION FOR REPRESENTATION

I appoint the following representative(s) as attorney(s) in fact:

Postal address

Taxpayer's social security number

Taxpayer's name

Spouse's first name and initial Last name Second last name

2. Representative(s) information

Zip code

Spouse's social security number

Telephone (Office)

Telephone (Home)

Employer's identification number

to represent the taxpayer(s) before the Department of the Treasury for the following tax matters:

Section 6176 of the Puerto Rico Internal Revenue Code of 1994, as amended, authorizes the Secretary of the Treasury to regulate the practice of the persons

representing the taxpayers before the Department of the Treasury. To enforce the provisions of this section, the taxpayer who wants to appoint a person to act

in his/her representation must complete this form.

Conservation Period: Six (6) years