Home > Legal >

Legal >

Power of Attorney Template > New York Power of Attorney Form >

New York Tax Power of Attorney Template

New York Tax Power of Attorney Form

At Speedy Template, You can download New York Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

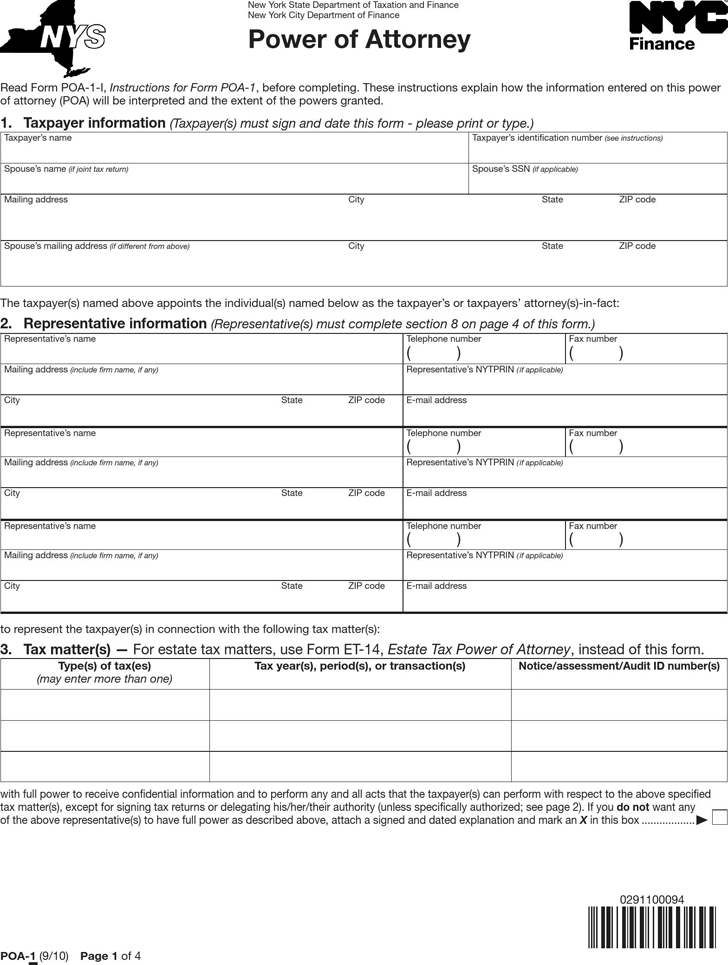

0291100094

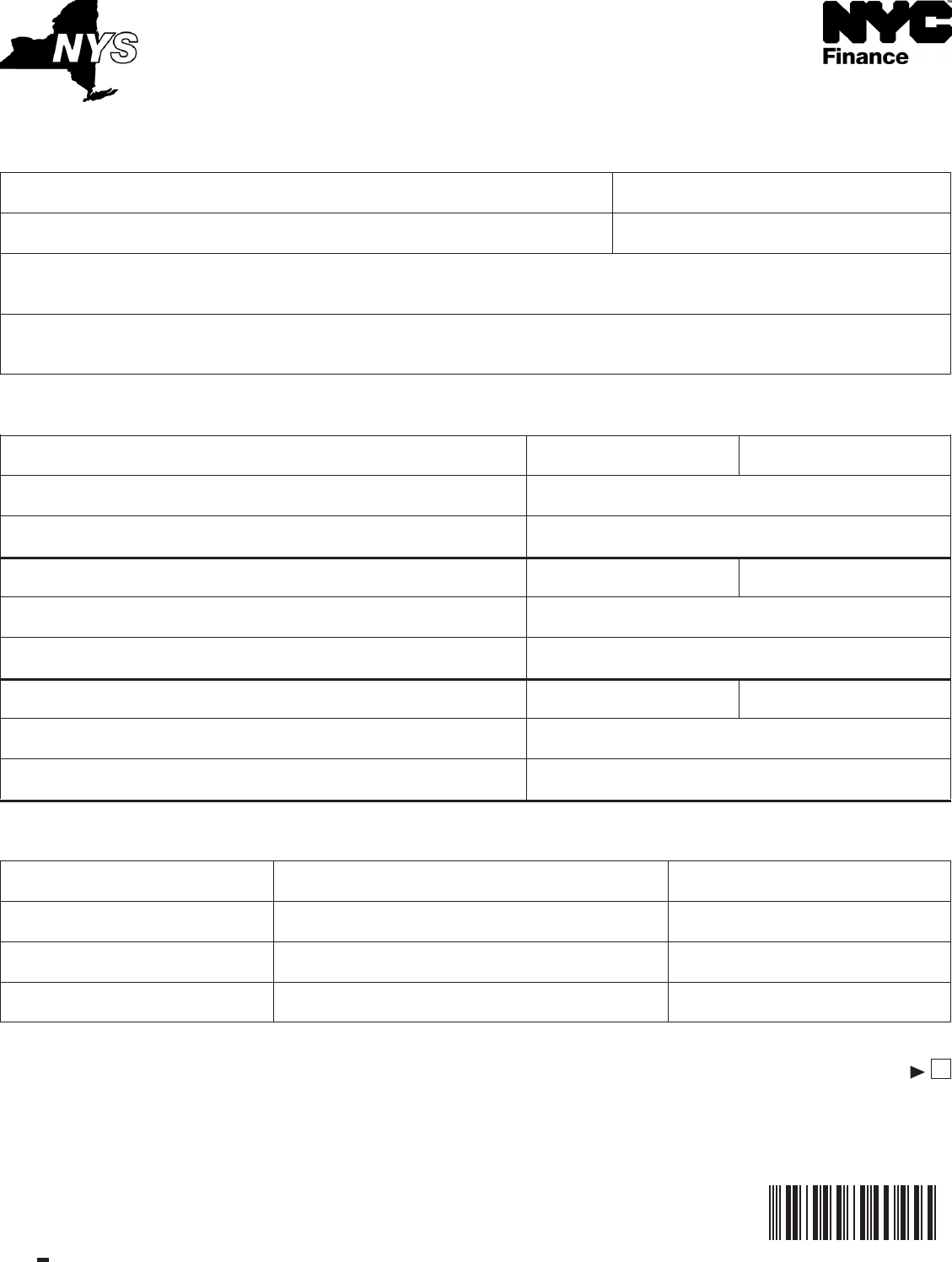

Taxpayer’s name Taxpayer’s identication number (see instructions)

Spouse’s name (if joint tax return) Spouse’s SSN (if applicable)

Mailing address City State ZIP code

Spouse’s mailing address

(if different from above) City State ZIP code

1. Taxpayer information (Taxpayer(s) must sign and date this form - please print or type.)

New York State Department of Taxation and Finance

New York City Department of Finance

Power of Attorney

Type(s) of tax(es) Tax year(s), period(s), or transaction(s)

Notice/assessment/Audit ID number(s)

(may enter more than one)

3. Tax matter(s) — For estate tax matters, use Form ET-14, Estate Tax Power of Attorney, instead of this form.

The taxpayer(s) named above appoints the individual(s) named below as the taxpayer’s or taxpayers’ attorney(s)-in-fact:

to represent the taxpayer(s) in connection with the following tax matter(s):

POA-1 (9/10) Page 1 of 4

Read Form POA-1-I, Instructions for Form POA-1, before completing. These instructions explain how the information entered on this power

of attorney (POA) will be interpreted and the extent of the powers granted.

Representative’s name Telephone number Fax number

( ) ( )

Mailing address (include firm name, if any) Representative’s NYTPRIN ( if applicable)

City State ZIP code E-mail address

Representative’s name Telephone number Fax number

( ) ( )

Mailing address (include firm name, if any) Representative’s NYTPRIN ( if applicable)

City State ZIP code E-mail address

Representative’s name Telephone number Fax number

( ) ( )

Mailing address (include firm name, if any) Representative’s NYTPRIN ( if applicable)

City State ZIP code E-mail address

2. Representative information (Representative(s) must complete section 8 on page 4 of this form.)

with full power to receive condential information and to perform any and all acts that the taxpayer(s) can perform with respect to the above specied

tax matter(s), except for signing tax returns or delegating his/her/their authority (unless specically authorized; see page 2). If you do not want any

of the above representative(s) to have full power as described above, attach a signed and dated explanation and mark an X in this box ..................