Home > Legal >

Legal >

Power of Attorney Template > New Hampshire Power of Attorney Form >

New Hampshire Tax Power of Attorney Template

New Hampshire Tax Power of Attorney Form

At Speedy Template, You can download New Hampshire Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The New Hampshire tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

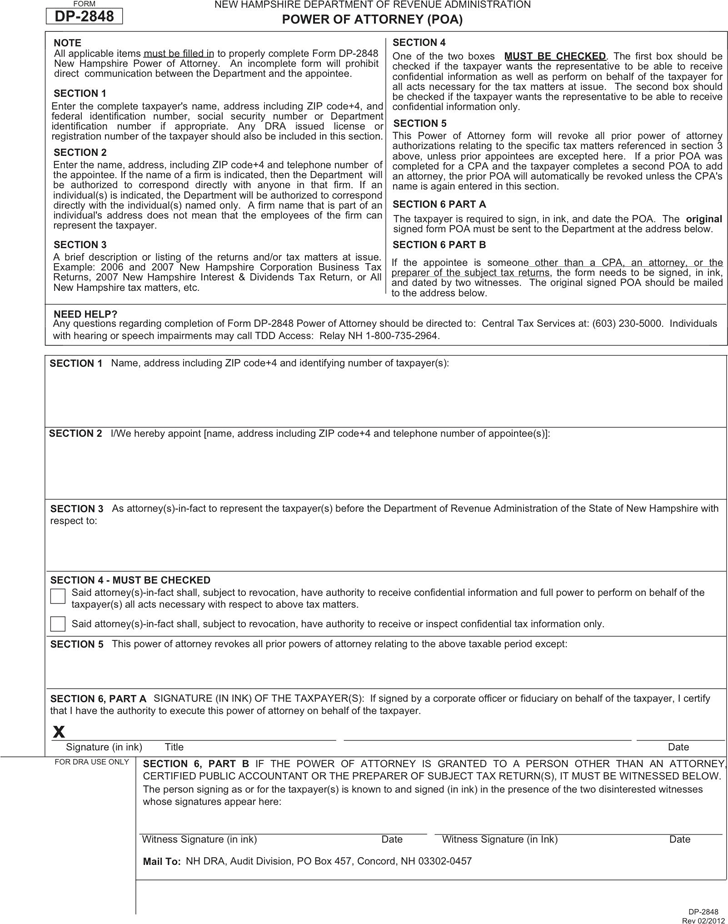

FORM

DP-2848

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

POWER OF ATTORNEY (POA)

SECTION 1

Name, address including ZIP code+4 and identifying number of taxpayer(s):

SECTION 2

I/We hereby appoint [name, address including ZIP code+4 and telephone number of appointee(s)]:

SECTION 3

As attorney(s)-in-fact to represent the taxpayer(s) before the Department of Revenue Administration of the State of New Hampshire with

respect to:

SECTION 6, PART A

SIGNATURE (IN INK) OF THE TAXPAYER(S): If signed by a corporate officer or fiduciary on behalf of the taxpayer, I certify

that I have the authority to execute this power of attorney on behalf of the taxpayer.

SECTION 6, PART B IF THE POWER OF ATTORNEY IS GRANTED TO A PERSON OTHER THAN AN ATTORNEY,

CERTIFIED PUBLIC ACCOUNTANT OR THE PREPARER OF SUBJECT TAX RETURN(S), IT MUST BE WITNESSED BELOW.

SECTION 5

This power of attorney revokes all prior powers of attorney relating to the above taxable period except:

Said attorney(s)-in-fact shall, subject to revocation, have authority to receive confidential information and full power to perform on behalf of the

taxpayer(s) all acts necessary with respect to above tax matters.

DP-2848

Rev 02/2012

The person signing as or for the taxpayer(s) is known to and signed (in ink) in the presence of the two disinterested witnesses

whose signatures appear here:

Witness Signature (in ink)

Date

Witness Signature (in Ink)

Date

Said attorney(s)-in-fact shall, subject to revocation, have authority to receive or inspect confidential tax information only.

SECTION 4 - MUST BE CHECKED

Signature

(in

ink) Title

Date

x

Mail To:

NH DRA, Audit Division, PO Box 457, Concord, NH 03302-0457

FOR DRA USE ONLY

NOTE

All applicable items must be filled in to properly complete Form DP-2848

New Hampshire Power of Attorney. An incomplete form will prohibit

direct communication between the Department and the appointee.

SECTION 1

Enter the complete taxpayer's name, address including ZIP code+4, and

federal identification number, social security number or Department

identification number if appropriate. Any DRA issued license or

registration number of the taxpayer should also be included in this section.

SECTION 2

Enter the name, address, including ZIP code+4 and telephone number of

the appointee. If the name of a firm is indicated, then the Department will

be authorized to correspond directly with anyone in that firm. If an

individual(s) is indicated, the Department will be authorized to correspond

directly with the individual(s) named only. A firm name that is part of an

individual's address does not mean that the employees of the firm can

represent the taxpayer.

SECTION 3

A brief description or listing of the returns and/or tax matters at issue.

Example: 2006 and 2007 New Hampshire Corporation Business Tax

Returns, 2007 New Hampshire Interest & Dividends Tax Return, or All

New Hampshire tax matters, etc.

SECTION 4

One of the two boxes MUST BE CHECKED. The first box should be

checked if the taxpayer wants the representative to be able to receive

confidential information as well as perform on behalf of the taxpayer for

all acts necessary for the tax matters at issue. The second box should

be checked if the taxpayer wants the representative to be able to receive

confidential information only.

SECTION 5

This Power of Attorney form will revoke all prior power of attorney

authorizations relating to the specific tax matters referenced in section 3

above, unless prior appointees are excepted here. If a prior POA was

completed for a CPA and the taxpayer completes a second POA to add

an attorney, the prior POA will automatically be revoked unless the CPA's

name is again entered in this section.

SECTION 6 PART A

The taxpayer is required to sign, in ink, and date the POA. The original

signed form POA must be sent to the Department at the address below.

SECTION 6 PART B

If the appointee is someone other than a CPA, an attorney, or the

preparer of the subject tax returns, the form needs to be signed, in ink,

and dated by two witnesses. The original signed POA should be mailed

to the address below.

NEED HELP

Any questions regarding completion of Form DP-2848 Power of Attorney should be directed to: Central Tax Services at: (603) 230-5000. Individuals

with hearing or speech impairments may call TDD Access: Relay NH 1-800-735-2964.

New Hampshire Tax Power of Attorney Form