Home > Legal >

Legal >

Power of Attorney Template > Nebraska Power of Attorney Form >

Nebraska Tax Power of Attorney Template

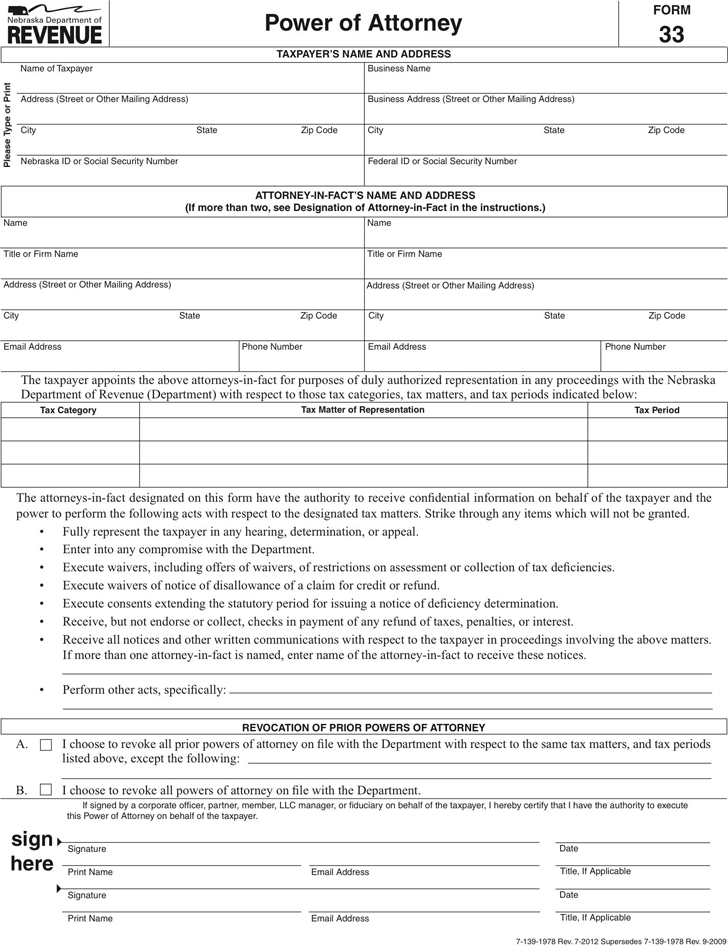

Nebraska Tax Power of Attorney Form

At Speedy Template, You can download Nebraska Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Nebraska tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

Name of Taxpayer

Address (Street or Other Mailing Address)

City

Nebraska ID or Social Security Number

Zip Code

State

Business Name

Business Address (Street or Other Mailing Address)

City

Federal ID or Social Security Number

Zip Code

State

Name

Title or Firm Name

Name

Title or Firm Name

Zip Code

City

Email Address Phone Number Email Address Phone Number

State

Address (Street or Other Mailing Address)

City

Zip Code

State

Address (Street or Other Mailing Address)

ATTORNEY-IN-FACT’S NAME AND ADDRESS

(If more than two, see Designation of Attorney-in-Fact in the instructions.)

TAXPAYER’S NAME AND ADDRESS

The attorneys-in-fact designated on this form have the authority to receive condential information on behalf of the taxpayer and the

power to perform the following acts with respect to the designated tax matters. Strike through any items which will not be granted.

• Fully represent the taxpayer in any hearing, determination, or appeal.

• Enter into any compromise with the Department.

• Execute waivers, including offers of waivers, of restrictions on assessment or collection of tax deciencies.

• Execute waivers of notice of disallowance of a claim for credit or refund.

• Execute consents extending the statutory period for issuing a notice of deciency determination.

• Receive, but not endorse or collect, checks in payment of any refund of taxes, penalties, or interest.

• Receive all notices and other written communications with respect to the taxpayer in proceedings involving the above matters.

If more than one attorney-in-fact is named, enter name of the attorney-in-fact to receive these notices.

• Perform other acts, specically:

7-139-1978 Rev. 7-2012 Supersedes 7-139-1978 Rev. 9-2009

Date

Date

Title, If Applicable

Title, If Applicable

Signature

Print Name Email Address

Signature

Print Name Email Address

Power of Attorney

FORM

33

The taxpayer appoints the above attorneys-in-fact for purposes of duly authorized representation in any proceedings with the Nebraska

Department of Revenue (Department) with respect to those tax categories, tax matters, and tax periods indicated below:

If signed by a corporate officer, partner, member, LLC manager, or fiduciary on behalf of the taxpayer, I hereby certify that I have the authority to execute

this Power of Attorney on behalf of the taxpayer.

Tax Matter of Representation

Tax Category Tax Period

sign

here

REVOCATION OF PRIOR POWERS OF ATTORNEY

A. I choose to revoke all prior powers of attorney on le with the Department with respect to the same tax matters, and tax periods

listed above, except the following:

B. I choose to revoke all powers of attorney on le with the Department.

RESET

PRINT