Home > Legal >

Legal >

Rent and Lease Template > Massachusetts Rent and Lease Template >

Massachusetts Commercial Lease Agreement

Massachusetts Commercial Lease Agreement

At Speedy Template, You can download Massachusetts Commercial Lease Agreement . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

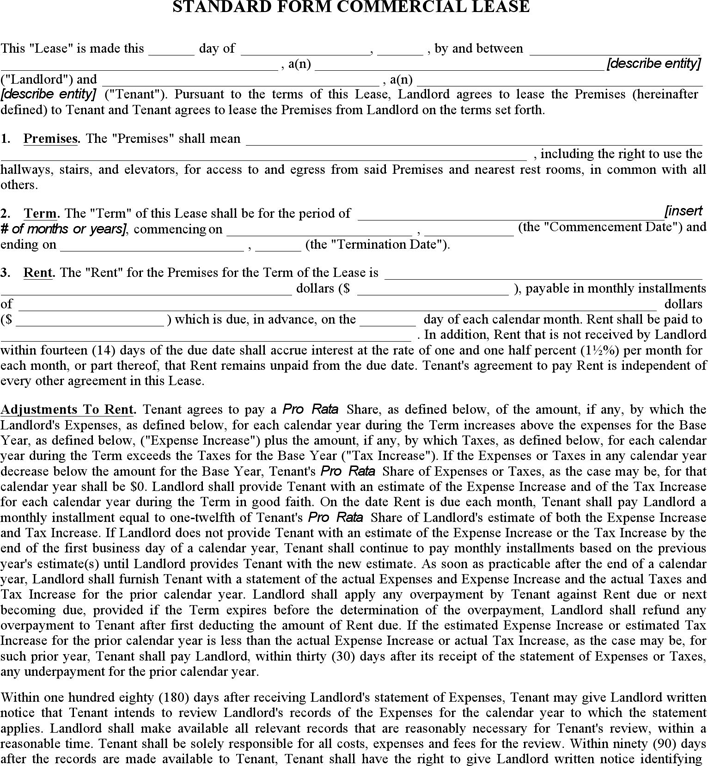

STANDARD FORM COMMERCIAL LEASE

This "Lease" is made this day of , , by and between

, a(n) [describe entity]

("Landlord") and , a(n)

[describe entity] ("Tenant"). Pursuant to the terms of this Lease, Landlord agrees to lease the Premises (hereinafter

defined) to Tenant and Tenant agrees to lease the Premises from Landlord on the terms set forth.

1. Premises. The "Premises" shall mean

, including the right to use the

hallways, stairs, and elevators, for access to and egress from said Premises and nearest rest rooms, in common with all

others.

2. Term. The "Term" of this Lease shall be for the period of

[insert

# of months or years], commencing on ,

(the "Commencement Date") and

ending on , (the "Termination Date").

3. Rent. The "Rent" for the Premises for the Term of the Lease is

dollars ($ ), payable in monthly installments

of dollars

($ ) which is due, in advance, on the day of each calendar month. Rent shall be paid to

. In addition, Rent that is not received by Landlord

within fourteen (14) days of the due date shall accrue interest at the rate of one and one half percent (1½%) per month for

each month, or part thereof, that Rent remains unpaid from the due date. Tenant's agreement to pay Rent is independent of

every other agreement in this Lease.

Adjustments To Rent. Tenant agrees to pay a Pro Rata Share, as defined below, of the amount, if any, by which the

Landlord's Expenses, as defined below, for each calendar year during the Term increases above the expenses for the Base

Year, as defined below, ("Expense Increase") plus the amount, if any, by which Taxes, as defined below, for each calendar

year during the Term exceeds the Taxes for the Base Year ("Tax Increase"). If the Expenses or Taxes in any calendar year

decrease below the amount for the Base Year, Tenant's Pro Rata Share of Expenses or Taxes, as the case may be, for that

calendar year shall be $0. Landlord shall provide Tenant with an estimate of the Expense Increase and of the Tax Increase

for each calendar year during the Term in good faith. On the date Rent is due each month, Tenant shall pay Landlord a

monthly installment equal to one-twelfth of Tenant's Pro Rata Share of Landlord's estimate of both the Expense Increase

and Tax Increase. If Landlord does not provide Tenant with an estimate of the Expense Increase or the Tax Increase by the

end of the first business day of a calendar year, Tenant shall continue to pay monthly installments based on the previous

year's estimate(s) until Landlord provides Tenant with the new estimate. As soon as practicable after the end of a calendar

year, Landlord shall furnish Tenant with a statement of the actual Expenses and Expense Increase and the actual Taxes and

Tax Increase for the prior calendar year. Landlord shall apply any overpayment by Tenant against Rent due or next

becoming due, provided if the Term expires before the determination of the overpayment, Landlord shall refund any

overpayment to Tenant after first deducting the amount of Rent due. If the estimated Expense Increase or estimated Tax

Increase for the prior calendar year is less than the actual Expense Increase or actual Tax Increase, as the case may be, for

such prior year, Tenant shall pay Landlord, within thirty (30) days after its receipt of the statement of Expenses or Taxes,

any underpayment for the prior calendar year.

Within one hundred eighty (180) days after receiving Landlord's statement of Expenses, Tenant may give Landlord written

notice that Tenant intends to review Landlord's records of the Expenses for the calendar year to which the statement

applies. Landlord shall make available all relevant records that are reasonably necessary for Tenant's review, within a

reasonable time. Tenant shall be solely responsible for all costs, expenses and fees for the review. Within ninety (90) days

after the records are made available to Tenant, Tenant shall have the right to give Landlord written notice identifying