Home > Legal >

Legal >

Power of Attorney Template > Kansas Power of Attorney Form >

Kansas Tax Power of Attorney Template

Kansas Tax Power of Attorney Form

At Speedy Template, You can download Kansas Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Kansas tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

_________________________________________________________ ________________________________________________ ________________________

_________________________________________________________ ________________________________________________ ________________________

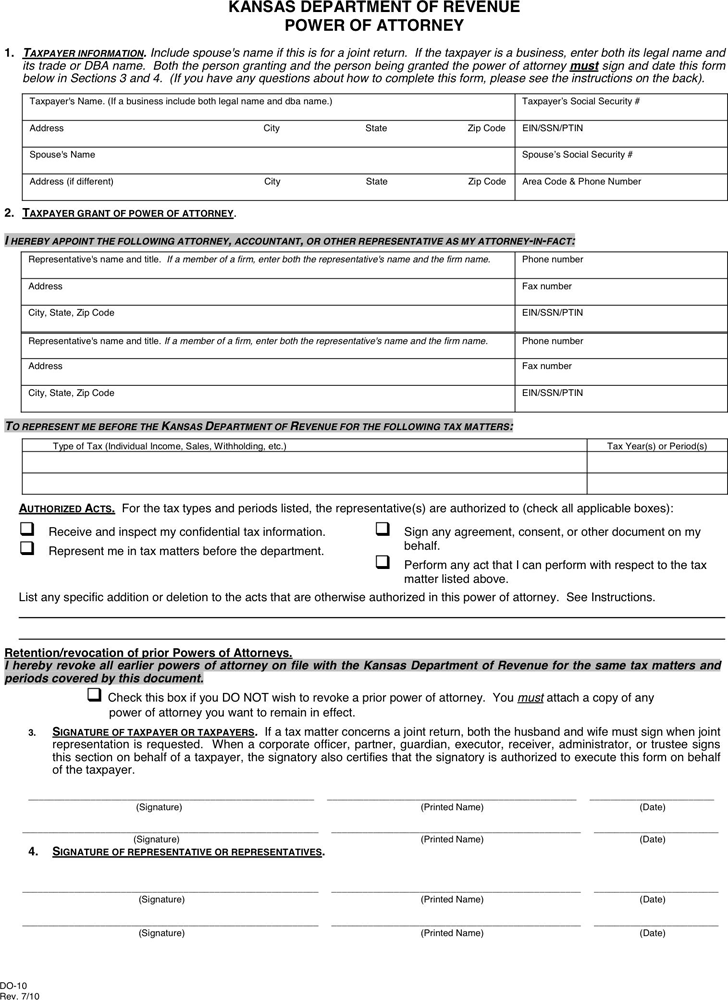

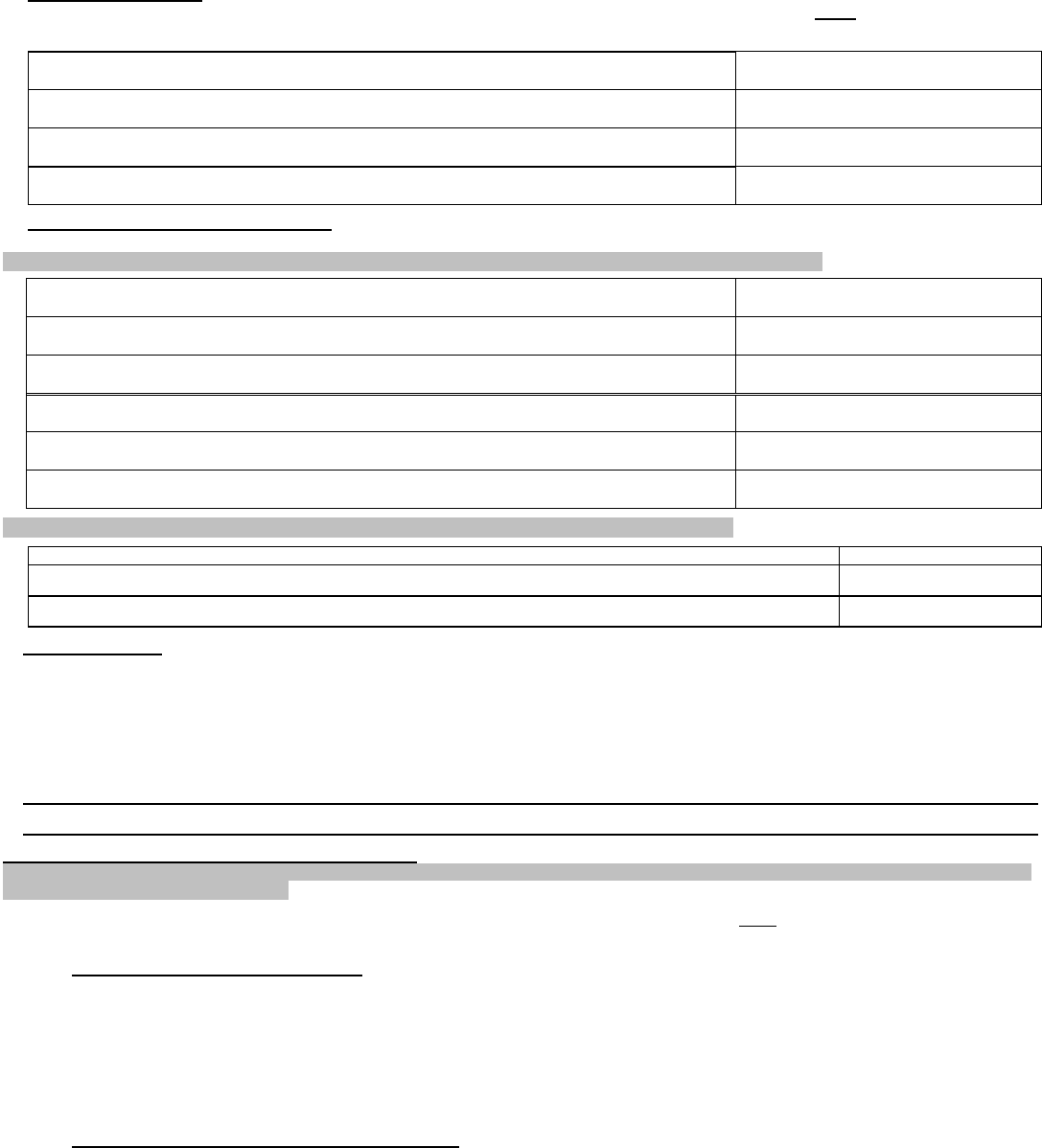

KANSAS DEPARTMENT OF REVENUE

POWER OF ATTORNEY

1. TAXPAYER INFORMATION. Include spouse's name if this is for a joint return. If the taxpayer is a business, enter both its legal name and

its trade or DBA name. Both the person granting and the person being granted the power of attorney must sign and date this form

below in Sections 3 and 4. (If you have any questions about how to complete this form, please see the instructions on the back).

Taxpayer's Name. (If a business include both legal name and dba name.) Taxpayer’s Social Security #

Address City State Zip Code EIN/SS

N/PTIN

S

pouse's Name Spouse’s Social Security #

Address (if different) City State Zip Code Area Code & Phone Number

2. TAXPAYER GRANT OF POWER OF ATTORNEY.

I HEREBY APPOINT THE FOLLOWING ATTORNEY, ACCOUNTANT, OR OTHER REPRESENTATIVE AS MY ATTORNEY-IN-FACT:

Representative's name and title. If a member of a firm, enter both the representative's name and the firm name. Phone number

Address Fax number

City, State, Zip Code EIN/SSN

/PTIN

Representative's name and title. If a member of a firm, enter both the representative's name and the firm name. Phone number

Address Fax number

City, State, Zip Code EIN/SSN

/PTIN

TO REPRESENT ME BEFORE THE KANSAS DEPARTMENT OF REVENUE FOR THE FOLLOWING TAX MATTERS:

Type of Tax (Individual Income, Sales, Withholding, etc.) Tax Year(s) or Period(s)

AUTHORIZED ACTS. For the tax types and periods listed, the representative(s) are authorized to (check all applicable boxes):

1 Receive and inspect my confidential tax information. 1 Sign any agreement, consent, or other document on my

behalf.

1 Represent me in tax matters before the department.

1 Perform any act that I can perform with respect to the tax

matter listed above.

List any specific addition or deletion to the acts that are otherwise authorized in this power of attorney. See Instructions.

Retention/revocation of prior Powers of Attorneys.

I hereby revoke all earlier powers of attorney on file with the Kansas Department of Revenue for the same tax matters and

periods covered by this document.

1 Check this box if you DO NOT wish to revoke a prior power of attorney. You must attach a copy of any

power of attorney you want to remain in effect.

3. SIGNATURE OF TAXPAYER OR TAXPAYERS. If a tax matter concerns a joint return, both the husband and wife must sign when joint

representation is requested. When a corporate officer, partner, guardian, executor, receiver, administrator, or trustee signs

this section on behalf of a taxpayer, the signatory also certifies that the signatory is authorized to execute this form on behalf

of the taxpayer.

_______________________________________________________ ________________________________________________ ________________________

(Signature) (Printed Name) (Date)

_________________________________________________________ ________________________________________________ ________________________

(Signature) (Printed Name) (Date)

4. SIGNATURE OF REPRESENTATIVE OR REPRESENTATIVES.

(Signature) (Printed Name) (Date)

(Signature) (Printed Name) (Date)

DO-10

Rev. 7/10