Iowa Child Support Worksheet Form

At Speedy Template, You can download Iowa Child Support Worksheet Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

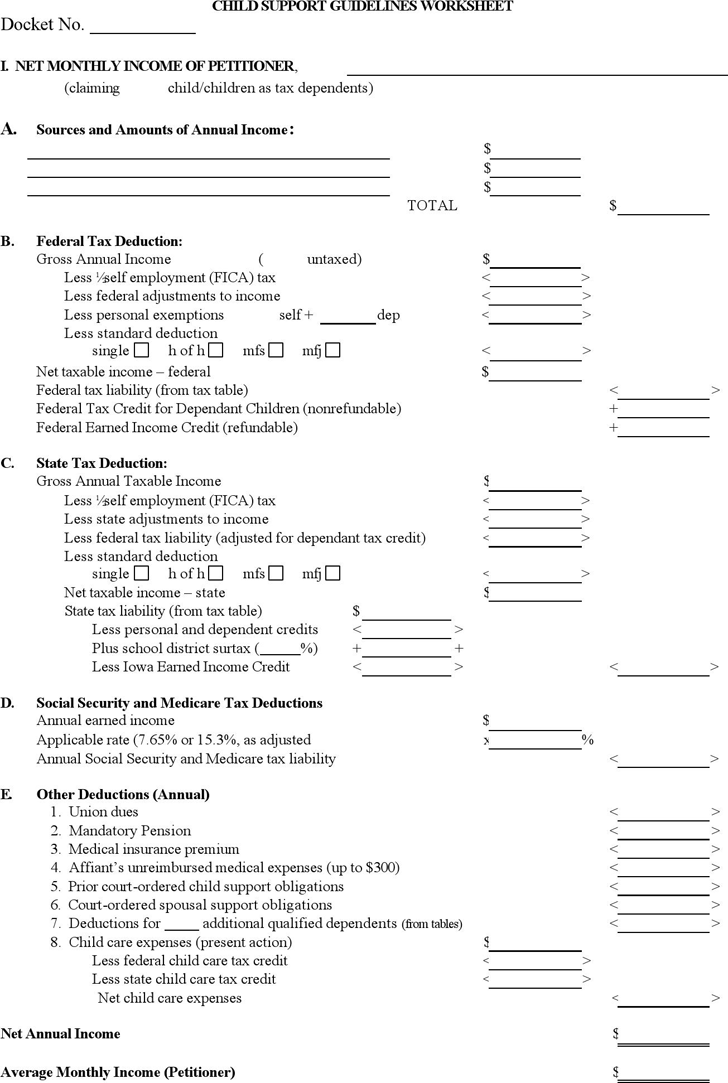

CHILD SUPPORT GUIDELINES WORKSHEET

Docket No.

I. NET MONTHLY INCOME OF PETITIONER,

(claiming child/children as tax dependents)

A. Sources and Amounts of Annual Income:

$

$

$

TOTAL $

B. Federal Tax Deduction:

Gross Annual Income ( untaxed)

$

Less ½ self employment (FICA) tax < >

Less federal adjustments to income < >

Less personal exemptions self + dep

<

>

Less standard deduction

single h of h mfs mfj < >

Net taxable income – federal

$

Federal tax liability (from tax table) < >

Federal Tax Credit for Dependant Children (nonrefundable) +

Federal Earned Income Credit (refundable) +

C. State Tax Deduction:

Gross Annual Taxable Income

$

Less ½ self employment (FICA) tax

<

>

Less state adjustments to income

<

>

Less federal tax liability (adjusted for dependant tax credit)

<

>

Less standard deduction

single h of h mfs mfj

<

>

Net taxable income – state

$

State tax liability (from tax table) $

Less personal and dependent credits <

>

Plus school district surtax ( %) +

+

Less Iowa Earned Income Credit <

> < >

D. Social Security and Medicare Tax Deductions

Annual earned income

$

Applicable rate (7.65% or 15.3%, as adjusted

x

%

Annual Social Security and Medicare tax liability < >

E. Other Deductions (Annual)

1. Union dues < >

2. Mandatory Pension < >

3. Medical insurance premium < >

4. Affiant’s unreimbursed medical expenses (up to $300) < >

5. Prior court-ordered child support obligations < >

6. Court-ordered spousal support obligations < >

7. Deductions for additional qualified dependents (from tables) < >

8. Child care expenses (present action)

$

Less federal child care tax credit

<

>

Less state child care tax credit

<

>

Net child care expenses

<

>

Net Annual Income

$

Average Monthly Income (Petitioner)

$