Home > Business >

Business >

Bill of Sale Template > New York Bill of Sale Form >

New York Bill of Sale Template

New York Bill of Sale Form

At Speedy Template, You can download New York Bill of Sale Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

DTF-802 (1/11)(back)

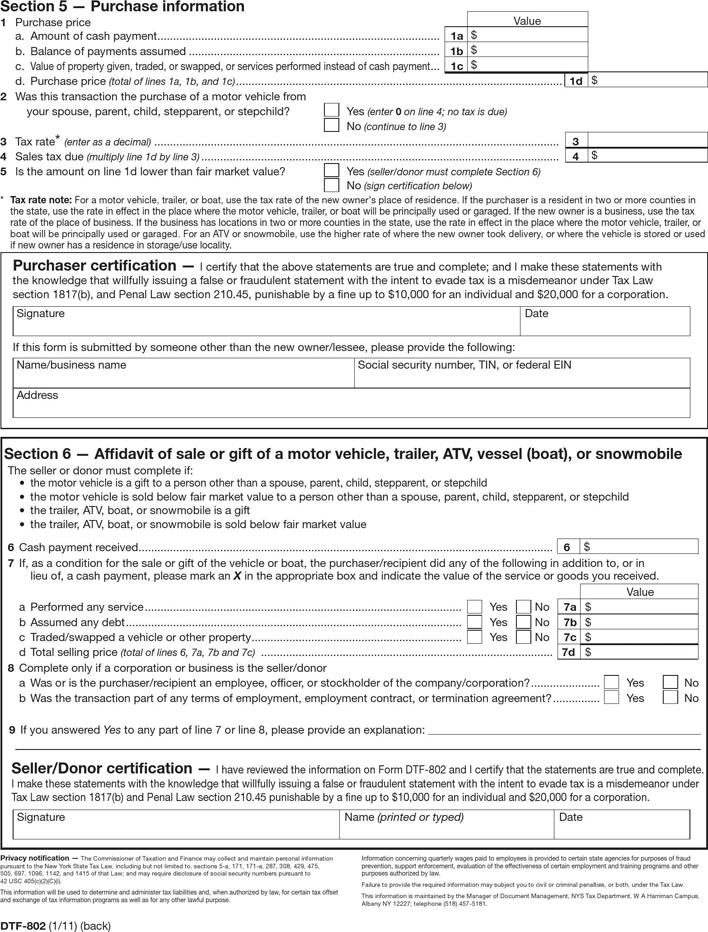

Purchaser certification — Icertifythattheabovestatementsaretrueandcomplete;andImakethesestatementswith

theknowledgethatwillfullyissuingafalseorfraudulentstatementwiththeintenttoevadetaxisamisdemeanorunderTaxLaw

section1817(b),andPenalLawsection210.45,punishablebyaneupto$10,000foranindividualand$20,000foracorporation.

If this form is submitted by someone other than the new owner/lessee, please provide the following:

Section 5 — Purchase information

1 Purchase price

Value

a. Amountofcashpayment .......................................................................................... 1a

$

b. Balanceofpaymentsassumed ................................................................................ 1b

$

c.

Valueofpropertygiven,traded,orswapped,orservicesperformedinsteadofcashpayment

... 1c

$

d. Purchase price

(total of lines 1a, 1b, and 1c) ........................................................................................................ 1d

$

2 Was this transaction the purchase of a motor vehicle from

your spouse, parent, child, stepparent, or stepchild Yes

(enter 0 on line 4; no tax is due)

No (continue to line 3)

3 Tax rate* (enter as a decimal) ................................................................................................................................. 3

4 Sales tax due

(multiply line 1d by line 3) .................................................................................................................. 4

$

5 Istheamountonline1dlowerthanfairmarketvalue Yes

(seller/donor must complete Section 6)

No (sign certification below)

*

Tax rate note:Foramotorvehicle,trailer,orboat,usethetaxrateofthenewowner'splaceofresidence.Ifthepurchaserisaresidentintwoormorecountiesin

the state, use the rate in effect in the place where the motor vehicle, trailer, or boat will be principally used or garaged. If the new owner is a business, use the tax

rate of the place of business. If the business has locations in two or more counties in the state, use the rate in effect in the place where the motor vehicle, trailer, or

boatwillbeprincipallyusedorgaraged.ForanATVorsnowmobile,usethehigherrateofwherethenewownertookdelivery,orwherethevehicleisstoredorused

if new owner has a residence in storage/use locality.

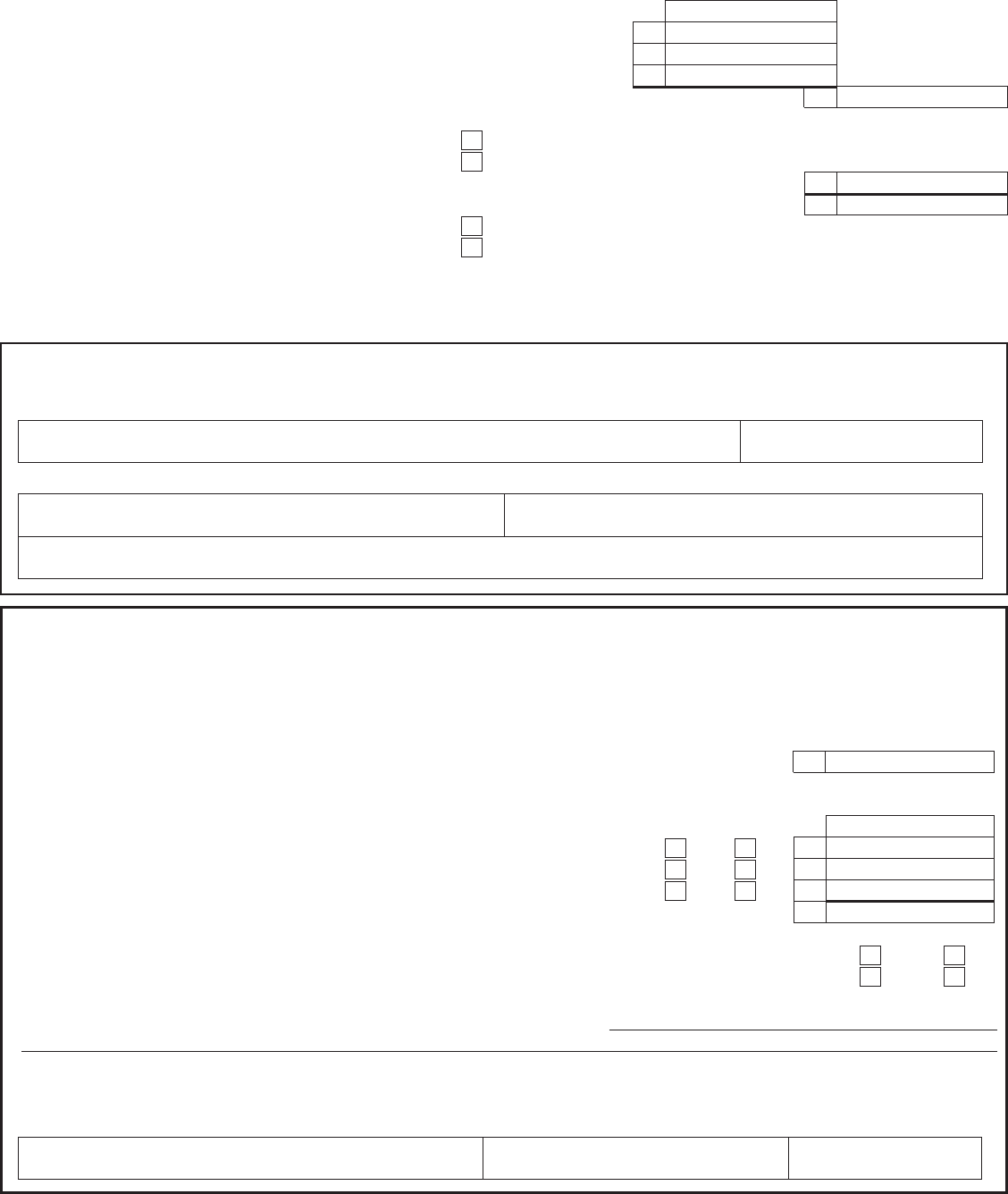

Section 6 — Affidavit of sale or gift of a motor vehicle, trailer, ATV, vessel (boat), or snowmobile

The seller or donor must complete if:

•

the motor vehicle is a gift to a person other than a spouse, parent, child, stepparent, or stepchild

• themotorvehicleissoldbelowfairmarketvaluetoapersonotherthanaspouse,parent,child,

stepparent,

or stepchild

• thetrailer,ATV,boat,orsnowmobileisagift

• thetrailer,ATV,boat,orsnowmobileissoldbelowfairmarketvalue

6 Cash payment received .................................................................................................................................... 6

$

7 If, as a condition for the sale or gift of the vehicle or boat, the purchaser/recipient did any of the following in addition to, or in

lieuof,acashpayment,pleasemarkanX in the appropriate box and indicate the value of the service or goods you received.

Value

a Performed any service ..................................................................................................... Yes No 7a$

b Assumedanydebt ........................................................................................................... Yes No 7b$

c Traded/swapped a vehicle or other property ................................................................... Yes No 7c$

d Total selling price

(total of lines 6, 7a, 7b and 7c) ............................................................................................. 7d$

8 Complete only if a corporation or business is the seller/donor

a Wasoristhepurchaser/recipientanemployee,ofcer,orstockholderofthecompany/corporation ...................... Yes No

b Was the transaction part of any terms of employment, employment contract, or termination agreement ............... Yes No

9 If you answered Yestoanypartofline7orline8,pleaseprovideanexplanation:

Seller/Donor certification —

IhavereviewedtheinformationonFormDTF-802andIcertifythatthestatementsaretrueandcomplete.

Imakethesestatementswiththeknowledgethatwillfullyissuingafalseorfraudulentstatementwiththeintenttoevadetaxisamisdemeanorunder

TaxLawsection1817(b)andPenalLawsection210.45punishablebyaneupto$10,000foranindividualand$20,000foracorporation.

Signature Name (printed or typed) Date

Signature Date

Name/business name Social security number, TIN, or federal EIN

Address

Privacy notification — TheCommissionerofTaxationandFinancemaycollectandmaintainpersonalinformation

pursuanttotheNewYorkStateTaxLaw,includingbutnotlimitedto,sections5-a,171,171-a,287,308,429,475,

505,697,1096,1142,and1415ofthatLaw;andmayrequiredisclosureofsocialsecuritynumberspursuantto

42USC405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset

and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud

prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other

purposes authorized by law.

Failuretoprovidetherequiredinformationmaysubjectyoutocivilorcriminalpenalties,orboth,undertheTaxLaw.

ThisinformationismaintainedbytheManagerofDocumentManagement,NYSTaxDepartment,WAHarrimanCampus,

AlbanyNY12227;telephone(518)457-5181.