Home > Legal >

Legal >

Affidavit Template > South Dakota Affidavit Form >

South Dakota Financial Affidavit Template

South Dakota Financial Affidavit Form

At Speedy Template, You can download South Dakota Financial Affidavit Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

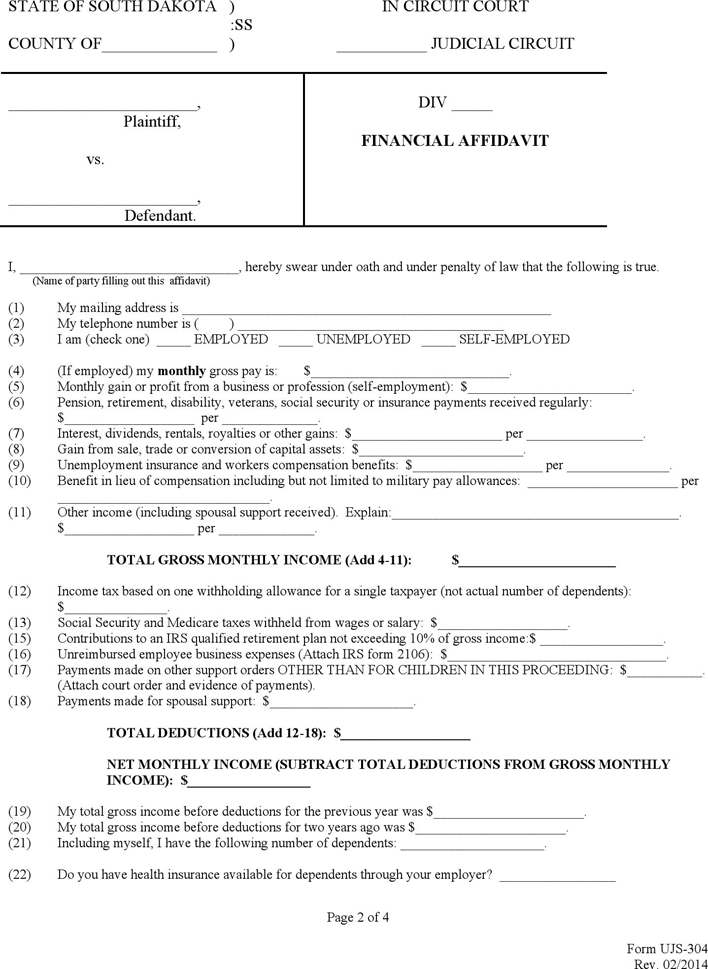

Page 2 of 4

Form UJS-304

Rev. 02/2014

STATE OF SOUTH DAKOTA )

IN CIRCUIT COURT

:SS

COUNTY OF______________ )

___________ JUDICIAL CIRCUIT

_______________________,

DIV _____

Plaintiff,

vs.

FINANCIAL AFFIDAVIT

_______________________,

Defendant.

I, ________________________________, hereby swear under oath and under penalty of law that the following is true.

(Name of party filling out this affidavit)

(1) My mailing address is ______________________________________________________

(2) My telephone number is ( ) _______________________________________

(3) I am (check one) _____ EMPLOYED _____ UNEMPLOYED _____ SELF-EMPLOYED

(4) (If employed) my monthly gross pay is: $_____________________________.

(5) Monthly gain or profit from a business or profession (self-employment): $________________________.

(6) Pension, retirement, disability, veterans, social security or insurance payments received regularly:

$___________________ per ______________.

(7) Interest, dividends, rentals, royalties or other gains: $______________________ per _________________.

(8) Gain from sale, trade or conversion of capital assets: $________________________.

(9) Unemployment insurance and workers compensation benefits: $___________________ per _______________.

(10) Benefit in lieu of compensation including but not limited to military pay allowances: ______________________ per

_______________________________.

(11) Other income (including spousal support received). Explain:__________________________________________.

$___________________ per ______________.

TOTAL GROSS MONTHLY INCOME (Add 4-11): $_______________________

(12) Income tax based on one withholding allowance for a single taxpayer (not actual number of dependents):

$_______________.

(13) Social Security and Medicare taxes withheld from wages or salary: $___________________.

(15) Contributions to an IRS qualified retirement plan not exceeding 10% of gross income:$ __________________.

(16) Unreimbursed employee business expenses (Attach IRS form 2106): $________________________________.

(17) Payments made on other support orders OTHER THAN FOR CHILDREN IN THIS PROCEEDING: $___________.

(Attach court order and evidence of payments).

(18) Payments made for spousal support: $_____________________.

TOTAL DEDUCTIONS (Add 12-18): $___________________

NET MONTHLY INCOME (SUBTRACT TOTAL DEDUCTIONS FROM GROSS MONTHLY

INCOME): $__________________

(19) My total gross income before deductions for the previous year was $______________________.

(20) My total gross income before deductions for two years ago was $______________________.

(21) Including myself, I have the following number of dependents: _____________________.

(22) Do you have health insurance available for dependents through your employer _________________