Home > Legal >

Legal >

Power of Attorney Template > Louisiana Power of Attorney Form >

Louisiana Tax Power of Attorney Template

Louisiana Tax Power of Attorney Form

At Speedy Template, You can download Louisiana Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Louisiana tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

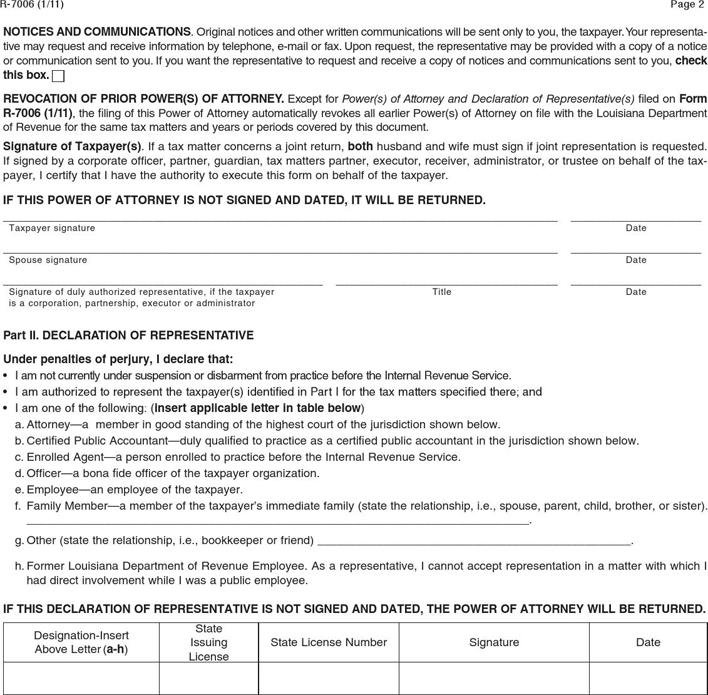

NOTICES AND COMMUNICATIONS. Original notices and other written communications will be sent only to you, the taxpayer. Your representa-

tive may request and receive information by telephone, e-mail or fax. Upon request, the representative may be provided with a copy of a notice

or communication sent to you. If you want the representative to request and receive a copy of notices and communications sent to you, check

this box.

■

REVOCATION OF PRIOR POWER(S) OF ATTORNEY. Except for Power(s) of Attorney and Declaration of Representative(s) led on Form

R-7006 (1/11), the ling of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on le with the Louisiana Department

of Revenue for the same tax matters and years or periods covered by this document.

Signature of Taxpayer(s). If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested.

If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the tax-

payer, I certify that I have the authority to execute this form on behalf of the taxpayer.

IF THIS POWER OF ATTORNEY IS NOT SIGNED AND DATED, IT WILL BE RETURNED.

_____________________________________________________________________________________

____________________

Taxpayer signature Date

_____________________________________________________________________________________ ____________________

Spouse signature Date

_________________________________________________ __________________________________ ____________________

Signature of duly authorized representative, if the taxpayer Title Date

is a corporation, partnership, executor or administrator

Part II. DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

• IamnotcurrentlyundersuspensionordisbarmentfrompracticebeforetheInternalRevenueService.

• Iamauthorizedtorepresentthetaxpayer(s)identiedinPartIforthetaxmattersspeciedthere;and

• Iamoneofthefollowing:(insert applicable letter in table below)

a. Attorney—a member in good standing of the highest court of the jurisdiction shown below.

b. Certied Public Accountant—duly qualied to practice as a certied public accountant in the jurisdiction shown below.

c. Enrolled Agent—a person enrolled to practice before the Internal Revenue Service.

d. Officer—a bona de officer of the taxpayer organization.

e. Employee—an employee of the taxpayer.

f. Family Member—a member of the taxpayer’s immediate family (state the relationship, i.e., spouse, parent, child, brother, or sister).

_____________________________________________________________________________.

g. Other (state the relationship, i.e., bookkeeper or friend) ________________________________________________.

h. Former Louisiana Department of Revenue Employee. As a representative, I cannot accept representation in a matter with which I

had direct involvement while I was a public employee.

IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED, THE POWER OF ATTORNEY WILL BE RETURNED.

Designation-Insert

Above Letter (a-h)

State

Issuing

License

State License Number Signature Date

R-7006 (1/11) Page 2