Home > Business >

Agreement Template >

Offer to Purchase Real Estate Template > North Carolina Offer to Purchase Real Estate Form >

North Carolina Offer To Purchase Real Estate Template

North Carolina Offer To Purchase Real Estate Form

At Speedy Template, You can download North Carolina Offer To Purchase Real Estate Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

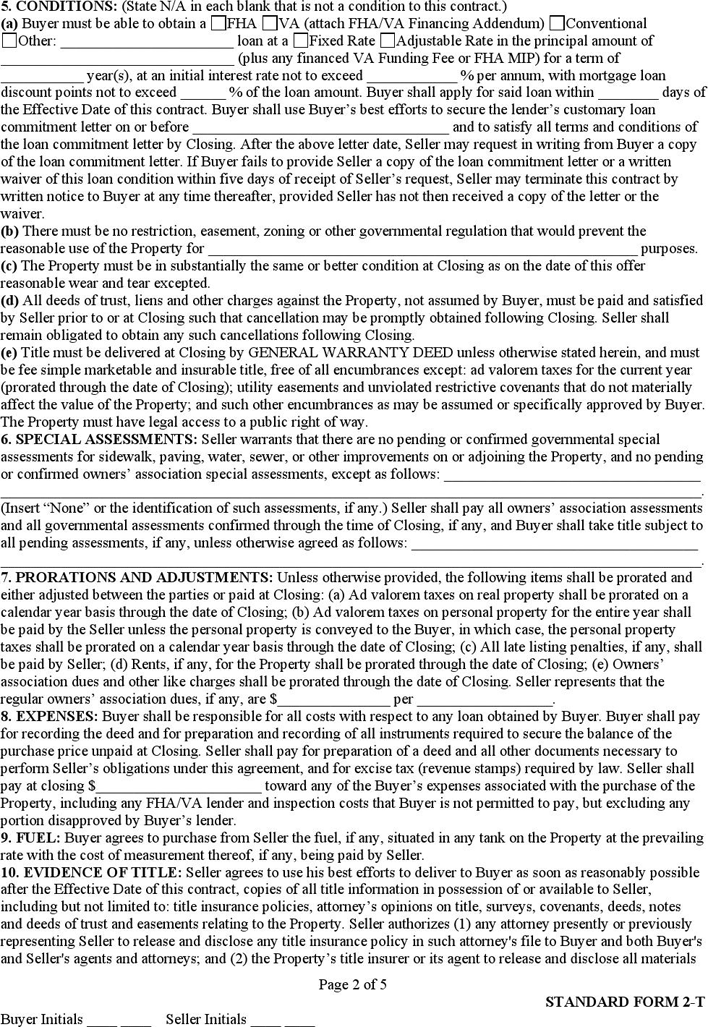

5. CONDITIONS: (State N/A in each blank that is not a condition to this contract.)

(a) Buyer must be able to obtain a

FHA VA (attach FHA/VA Financing Addendum) Conventional

Other: _______________________ loan at a Fixed Rate Adjustable Rate in the principal amount of

_______________________________ (plus any financed VA Funding Fee or FHA MIP) for a term of

___________ year(s), at an initial interest rate not to exceed ____________ % per annum, with mortgage loan

discount points not to exceed ______ % of the loan amount. Buyer shall apply for said loan within ________ days of

the Effective Date of this contract. Buyer shall use Buyer’s best efforts to secure the lender’s customary loan

commitment letter on or before __________________________________ and to satisfy all terms and conditions of

the loan commitment letter by Closing. After the above letter date, Seller may request in writing from Buyer a copy

of the loan commitment letter. If Buyer fails to provide Seller a copy of the loan commitment letter or a written

waiver of this loan condition within five days of receipt of Seller’s request, Seller may terminate this contract by

written notice to Buyer at any time thereafter, provided Seller has not then received a copy of the letter or the

waiver.

(b) There must be no restriction, easement, zoning or other governmental regulation that would prevent the

reasonable use of the Property for _________________________________________________________ purposes.

(c) The Property must be in substantially the same or better condition at Closing as on the date of this offer

reasonable wear and tear excepted.

(d) All deeds of trust, liens and other charges against the Property, not assumed by Buyer, must be paid and satisfied

by Seller prior to or at Closing such that cancellation may be promptly obtained following Closing. Seller shall

remain obligated to obtain any such cancellations following Closing.

(e) Title must be delivered at Closing by GENERAL WARRANTY DEED unless otherwise stated herein, and must

be fee simple marketable and insurable title, free of all encumbrances except: ad valorem taxes for the current year

(prorated through the date of Closing); utility easements and unviolated restrictive covenants that do not materially

affect the value of the Property; and such other encumbrances as may be assumed or specifically approved by Buyer.

The Property must have legal access to a public right of way.

6. SPECIAL ASSESSMENTS: Seller warrants that there are no pending or confirmed governmental special

assessments for sidewalk, paving, water, sewer, or other improvements on or adjoining the Property, and no pending

or confirmed owners’ association special assessments, except as follows: __________________________________

_____________________________________________________________________________________________.

(Insert “None” or the identification of such assessments, if any.) Seller shall pay all owners’ association assessments

and all governmental assessments confirmed through the time of Closing, if any, and Buyer shall take title subject to

all pending assessments, if any, unless otherwise agreed as follows: ______________________________________

_____________________________________________________________________________________________.

7. PRORATIONS AND ADJUSTMENTS: Unless otherwise provided, the following items shall be prorated and

either adjusted between the parties or paid at Closing: (a) Ad valorem taxes on real property shall be prorated on a

calendar year basis through the date of Closing; (b) Ad valorem taxes on personal property for the entire year shall

be paid by the Seller unless the personal property is conveyed to the Buyer, in which case, the personal property

taxes shall be prorated on a calendar year basis through the date of Closing; (c) All late listing penalties, if any, shall

be paid by Seller; (d) Rents, if any, for the Property shall be prorated through the date of Closing; (e) Owners’

association dues and other like charges shall be prorated through the date of Closing. Seller represents that the

regular owners’ association dues, if any, are $_______________ per __________________.

8. EXPENSES: Buyer shall be responsible for all costs with respect to any loan obtained by Buyer. Buyer shall pay

for recording the deed and for preparation and recording of all instruments required to secure the balance of the

purchase price unpaid at Closing. Seller shall pay for preparation of a deed and all other documents necessary to

perform Seller’s obligations under this agreement, and for excise tax (revenue stamps) required by law. Seller shall

pay at closing $______________________ toward any of the Buyer’s expenses associated with the purchase of the

Property, including any FHA/VA lender and inspection costs that Buyer is not permitted to pay, but excluding any

portion disapproved by Buyer’s lender.

9. FUEL: Buyer agrees to purchase from Seller the fuel, if any, situated in any tank on the Property at the prevailing

rate with the cost of measurement thereof, if any, being paid by Seller.

10. EVIDENCE OF TITLE: Seller agrees to use his best efforts to deliver to Buyer as soon as reasonably possible

after the Effective Date of this contract, copies of all title information in possession of or available to Seller,

including but not limited to: title insurance policies, attorney’s opinions on title, surveys, covenants, deeds, notes

and deeds of trust and easements relating to the Property. Seller authorizes (1) any attorney presently or previously

representing Seller to release and disclose any title insurance policy in such attorney's file to Buyer and both Buyer's

and Seller's agents and attorneys; and (2) the Property’s title insurer or its agent to release and disclose all materials

Page 2 of 5

STANDARD FORM 2-T

Buyer Initials ____ ____ Seller Initials ____ ____