Home > Legal >

Legal >

Power of Attorney Template > District of Columbia Power of Attorney Form >

District of Columbia Tax Power of Attorney Form 2

District of Columbia Tax Power of Attorney Form 2

At Speedy Template, You can download District of Columbia Tax Power of Attorney Form 2 . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

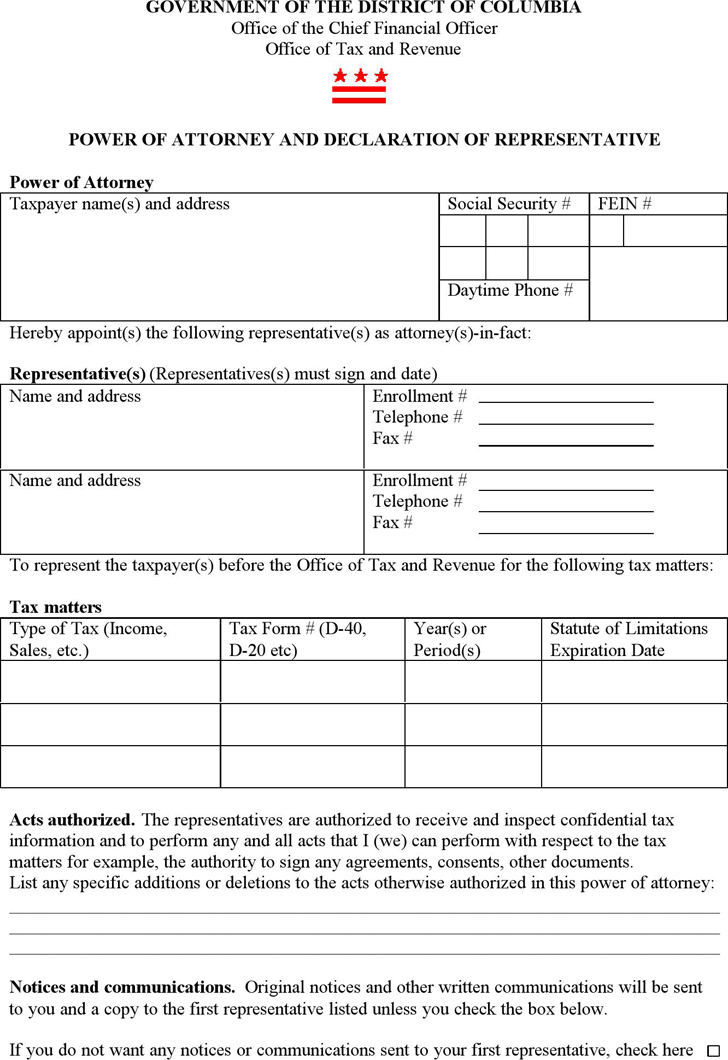

GOVERNMENT OF THE DISTRICT OF COLUMBIA

Office of the Chief Financial Officer

Office of Tax and Revenue

POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE

Power of Attorney

Social Security # FEIN #Taxpayer name(s) and address

Daytime Phone #

Hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

Representative(s) (Representatives(s) must sign and date)

Name and address Enrollment #

Telephone #

Fax #

Name and address Enrollment #

Telephone #

Fax #

To represent the taxpayer(s) before the Office of Tax and Revenue for the following tax matters:

Tax matters

Type of Tax (Income,

Sales, etc.)

Tax Form # (D-40,

D-20 etc)

Year(s) or

Period(s)

Statute of Limitations

Expiration Date

Acts authorized. The representatives are authorized to receive and inspect confidential tax

information and to perform any and all acts that I (we) can perform with respect to the tax

matters for example, the authority to sign any agreements, consents, other documents.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Notices and communications. Original notices and other written communications will be sent

to you and a copy to the first representative listed unless you check the box below.

If you do not want any notices or communications sent to your first representative, check here